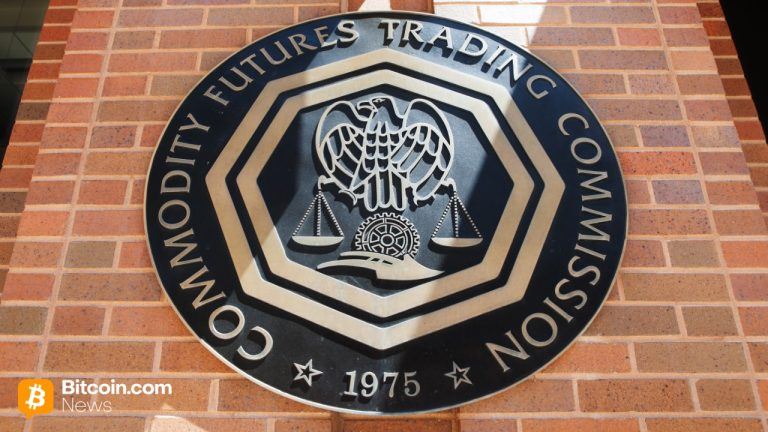

Institutional demand grows with new crypto treasuries and SEC reforms: Finance Redefined

PositiveCryptocurrency

Public firms are increasingly raising significant capital for cryptocurrency strategies, signaling a growing institutional demand in the market. This trend is important as it reinforces investor expectations for another historic altcoin market cycle, suggesting that the crypto space is gaining traction and legitimacy among traditional investors.

— Curated by the World Pulse Now AI Editorial System