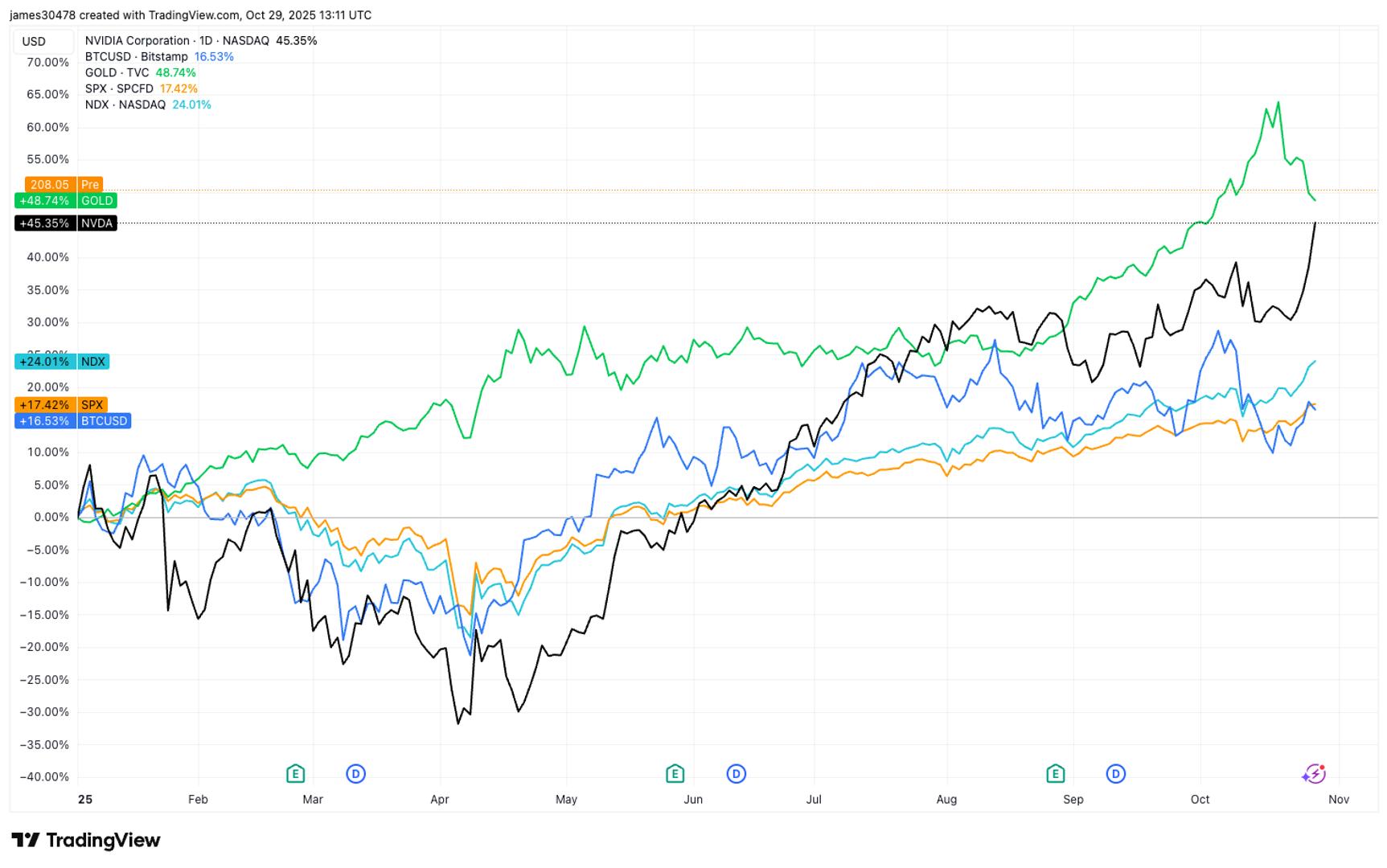

Nvidia Hits $5T Market Cap as Bitcoin Now Trails U.S. Equities Year to Date

NegativeCryptocurrency

Nvidia has reached a remarkable $5 trillion market cap, showcasing its dominance in the tech sector. However, Bitcoin is struggling, trailing behind U.S. equities like the S&P 500 and Nasdaq, and even falling short of gold's performance in 2025. This shift highlights the changing landscape of investment returns and raises questions about Bitcoin's future as a reliable asset.

— Curated by the World Pulse Now AI Editorial System