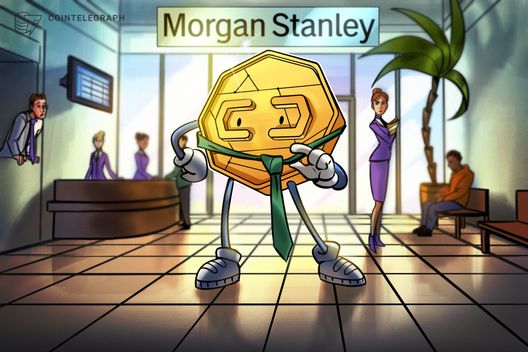

Morgan Stanley opens crypto investments to all clients

PositiveCryptocurrency

Morgan Stanley's decision to open crypto investments to all clients marks a significant step towards mainstream adoption of digital currencies. This move is likely to influence financial markets and regulatory landscapes globally, making it easier for more investors to participate in the crypto space. As traditional financial institutions embrace cryptocurrencies, it could pave the way for broader acceptance and innovation in the financial sector.

— Curated by the World Pulse Now AI Editorial System