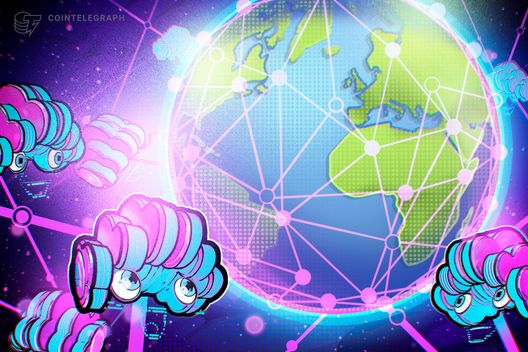

Decentralized compute networks will democratize global AI access

PositiveCryptocurrency

The rise of decentralized compute networks is set to transform global access to artificial intelligence. Currently, AI computing power is largely concentrated in developed countries, limiting opportunities for innovation elsewhere. By utilizing idle GPUs through blockchain technology, these networks can democratize access to AI resources, enabling a broader range of individuals and organizations to participate in AI development. This shift not only fosters inclusivity but also encourages diverse contributions to the AI landscape, making it a significant step towards a more equitable technological future.

— Curated by the World Pulse Now AI Editorial System