Bonds Outshine: Crypto Daybook Americas

NeutralCryptocurrency

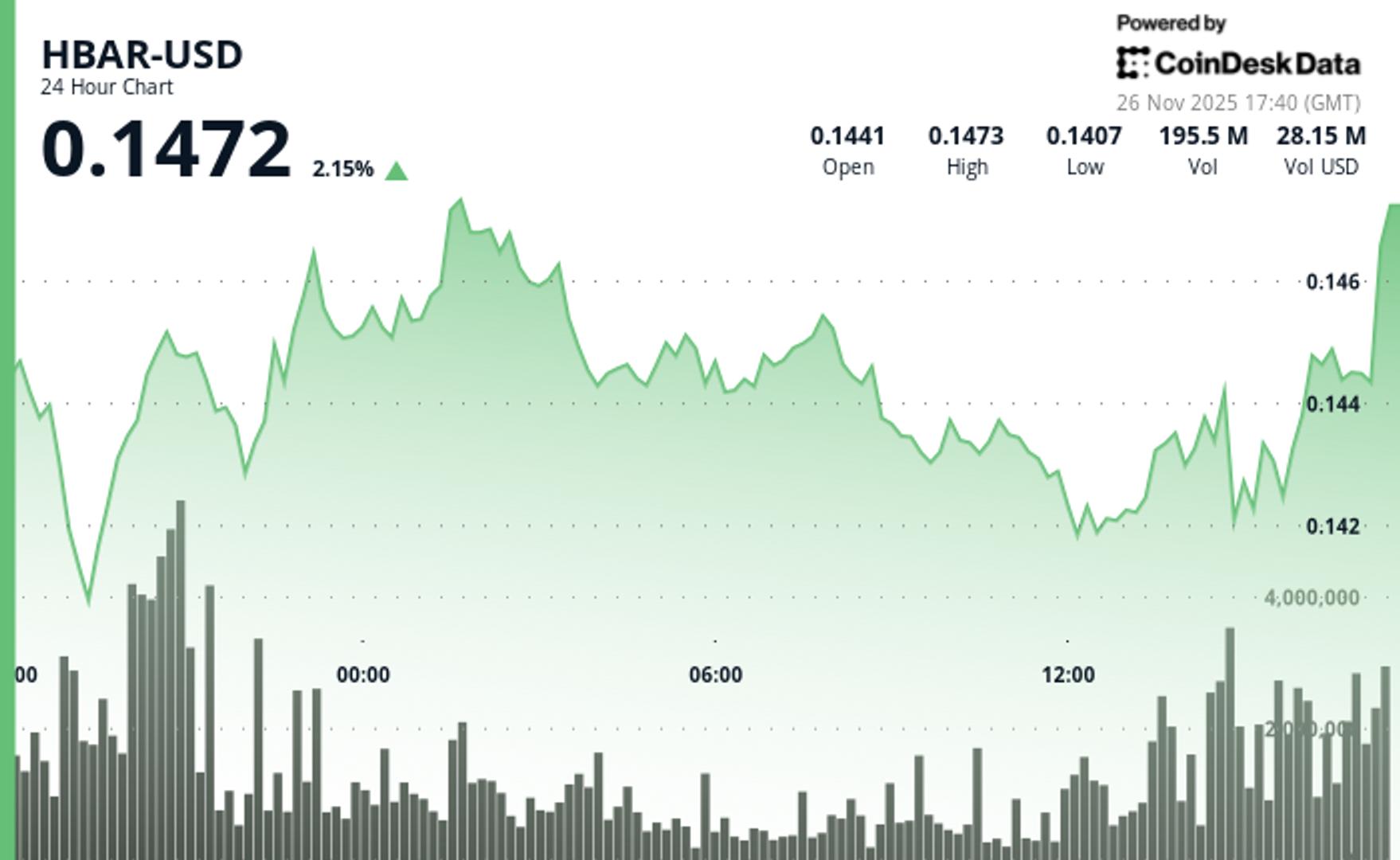

- The cryptocurrency market is currently experiencing significant volatility, with Bitcoin's price fluctuating around $86,000 after a recent rebound from earlier losses. This situation is highlighted in the Crypto Daybook Americas, which provides insights into the ongoing trends and developments in the market as of November 26, 2025.

- This development is crucial as it reflects the shifting dynamics within the cryptocurrency sector, particularly the performance of Bitcoin compared to altcoins, which continue to lag behind. The market's volatility impacts investor sentiment and corporate strategies regarding cryptocurrency holdings.

- The broader context reveals a trend where corporate Bitcoin treasuries are moving from a HODL strategy to more active management approaches, including yield generation and hedging, as firms face net asset value discounts. This shift indicates a growing need for companies to adapt their strategies in response to market pressures and changing investor expectations.

— via World Pulse Now AI Editorial System