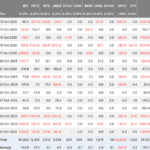

Public Firms With Private Keys: The Biggest BTC and ETH Stashes Right Now

PositiveCryptocurrency

Recent insights reveal that several public firms are holding significant amounts of Bitcoin and Ethereum, showcasing the growing acceptance of cryptocurrencies in mainstream finance. This trend is important as it highlights the increasing institutional interest in digital assets, potentially leading to greater market stability and innovation in the financial sector.

— Curated by the World Pulse Now AI Editorial System