$1T crypto market drawdown masks Bitcoin’s strong fundamentals: Coinbase exec

PositiveCryptocurrency

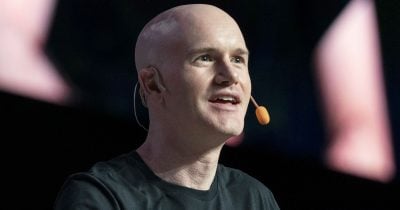

- Bitcoin has experienced a significant downturn, with a $1 trillion drop in the cryptocurrency market, but a Coinbase executive asserts that this decline is structural rather than a sign of weak fundamentals. The executive noted that Bitcoin's core value drivers have not changed since its peak in September.

- This situation is crucial for Coinbase as it navigates the challenges posed by the broader market decline, which has affected its stock performance and investor confidence. The emphasis on Bitcoin's strong fundamentals may help reassure stakeholders.

- The current market volatility highlights ongoing debates about the resilience of Bitcoin amid broader economic uncertainties. While some view this as a generational buying opportunity, others express concern over the potential for further declines, reflecting a divided sentiment among investors.

— via World Pulse Now AI Editorial System