Crypto Miner TeraWulf to Raise $3B in Google-Backed Debt Deal to Expand Data Centers

PositiveCryptocurrency

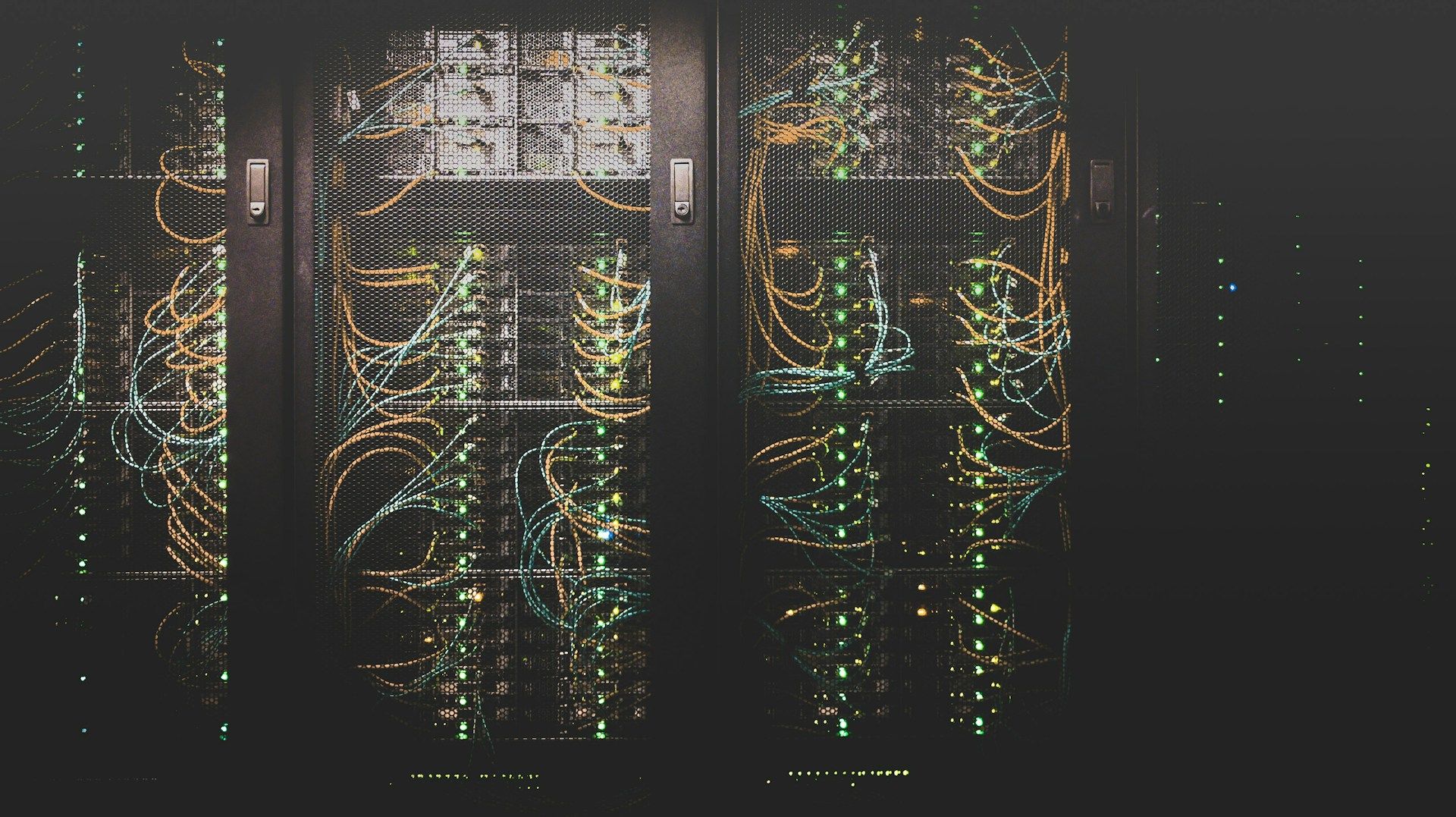

TeraWulf is set to raise $3 billion in a debt deal backed by Google, which already holds a 14% stake in the company. This significant investment will help TeraWulf expand its data centers, positioning itself strongly in the growing crypto market. Google's support not only highlights the tech giant's confidence in TeraWulf but also its commitment to backing innovative crypto firms like Cipher Mining as they venture into AI. This move is crucial as it reflects the increasing intersection of cryptocurrency and technology, paving the way for future advancements.

— Curated by the World Pulse Now AI Editorial System