XRP Surges 7% in Strongest Breakout in Weeks as Ripple Linked ETFs Go Live

PositiveCryptocurrency

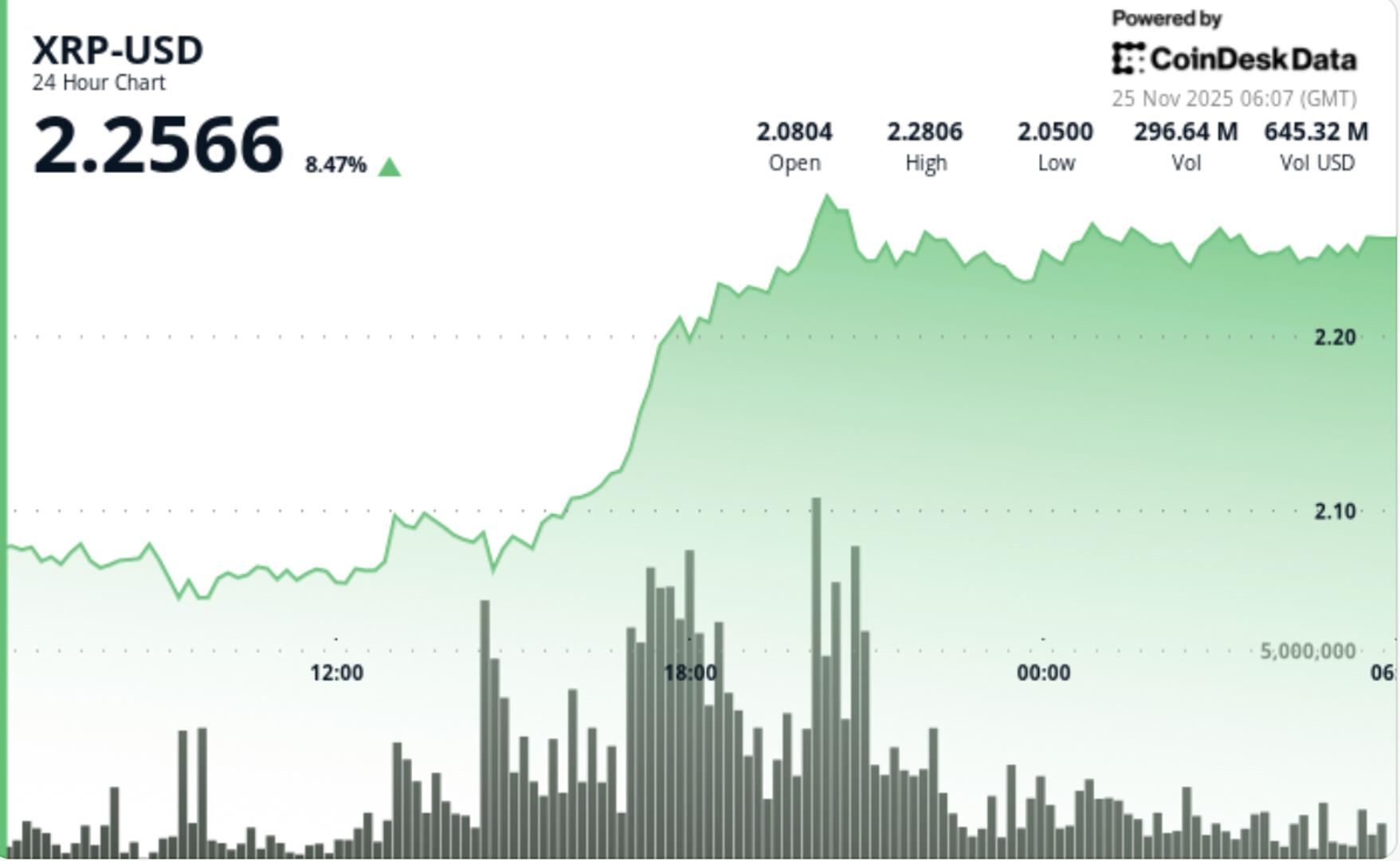

- XRP experienced a significant surge of 7%, marking its strongest breakout in weeks, coinciding with the launch of Ripple-linked exchange-traded funds (ETFs). This increase reflects a growing interest in XRP as institutional investors begin to engage more actively with the cryptocurrency market.

- The launch of these ETFs is pivotal for Ripple and XRP, as it not only enhances liquidity but also signals a shift in investor sentiment towards cryptocurrencies, particularly in a market that has faced recent downturns.

- The strong inflows into XRP and Solana ETFs, totaling nearly $900 million, highlight a divergence in investor confidence amid broader market volatility. This trend suggests that while many cryptocurrencies struggle, XRP is positioned for potential growth, driven by institutional interest and strategic market movements.

— via World Pulse Now AI Editorial System