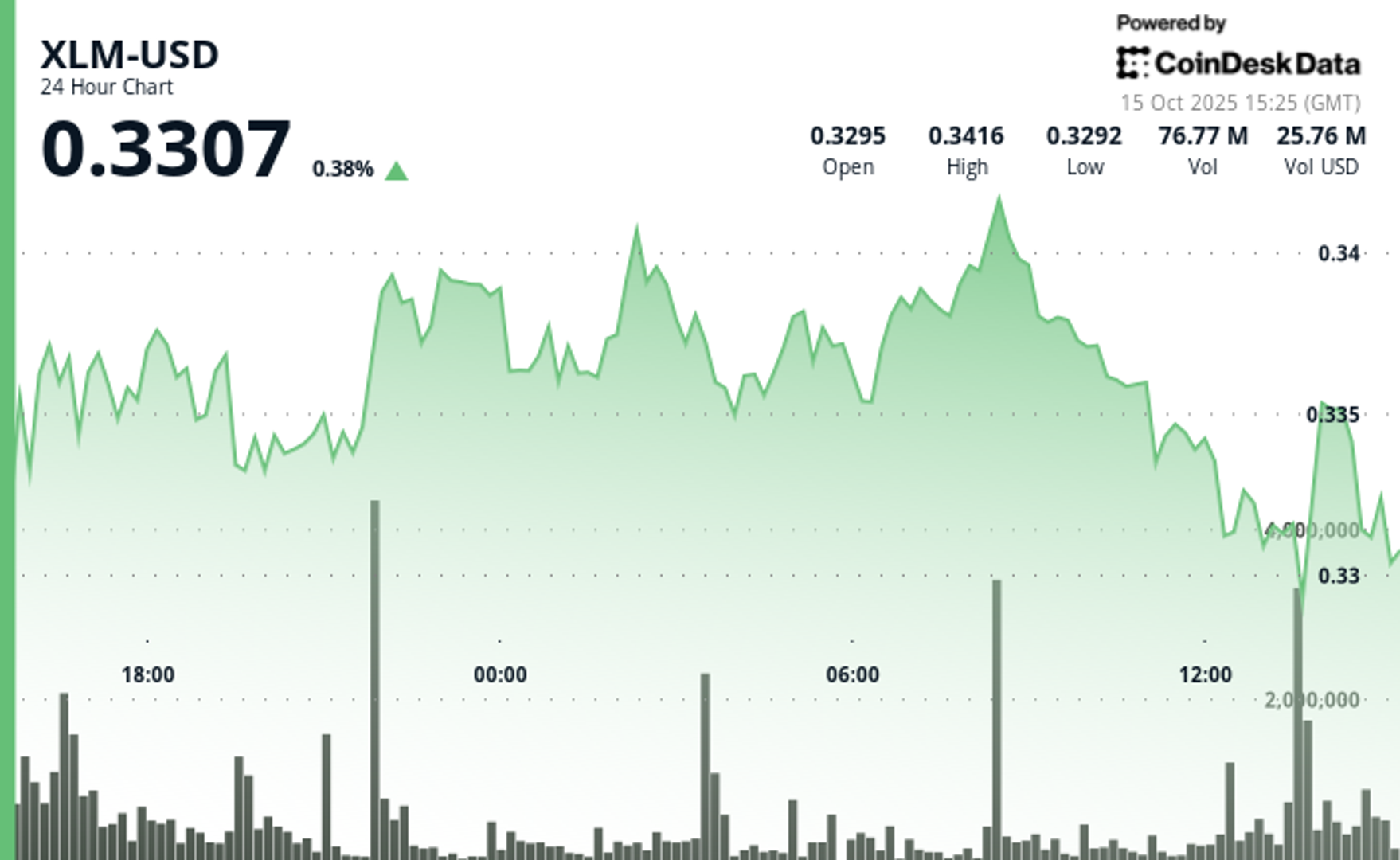

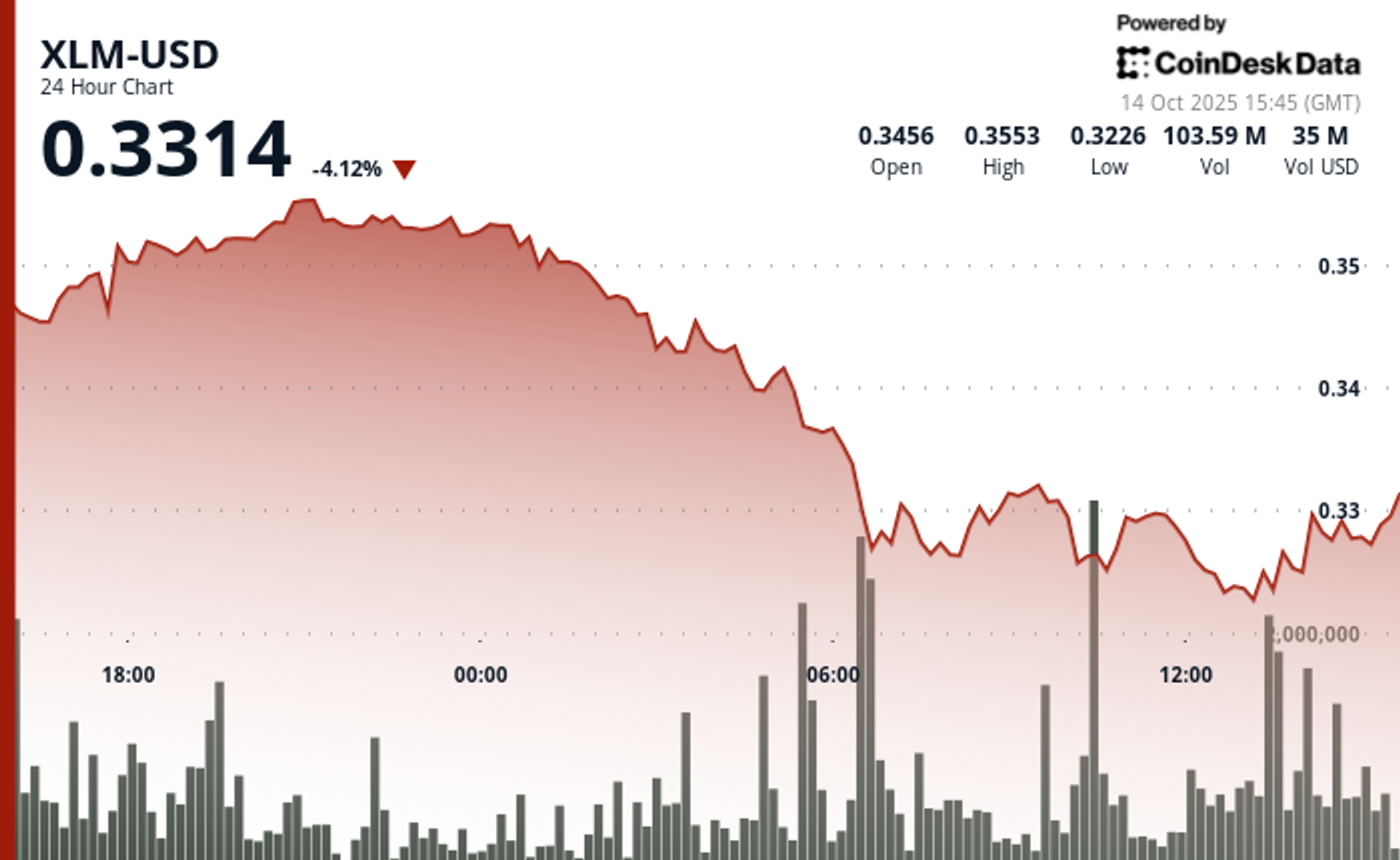

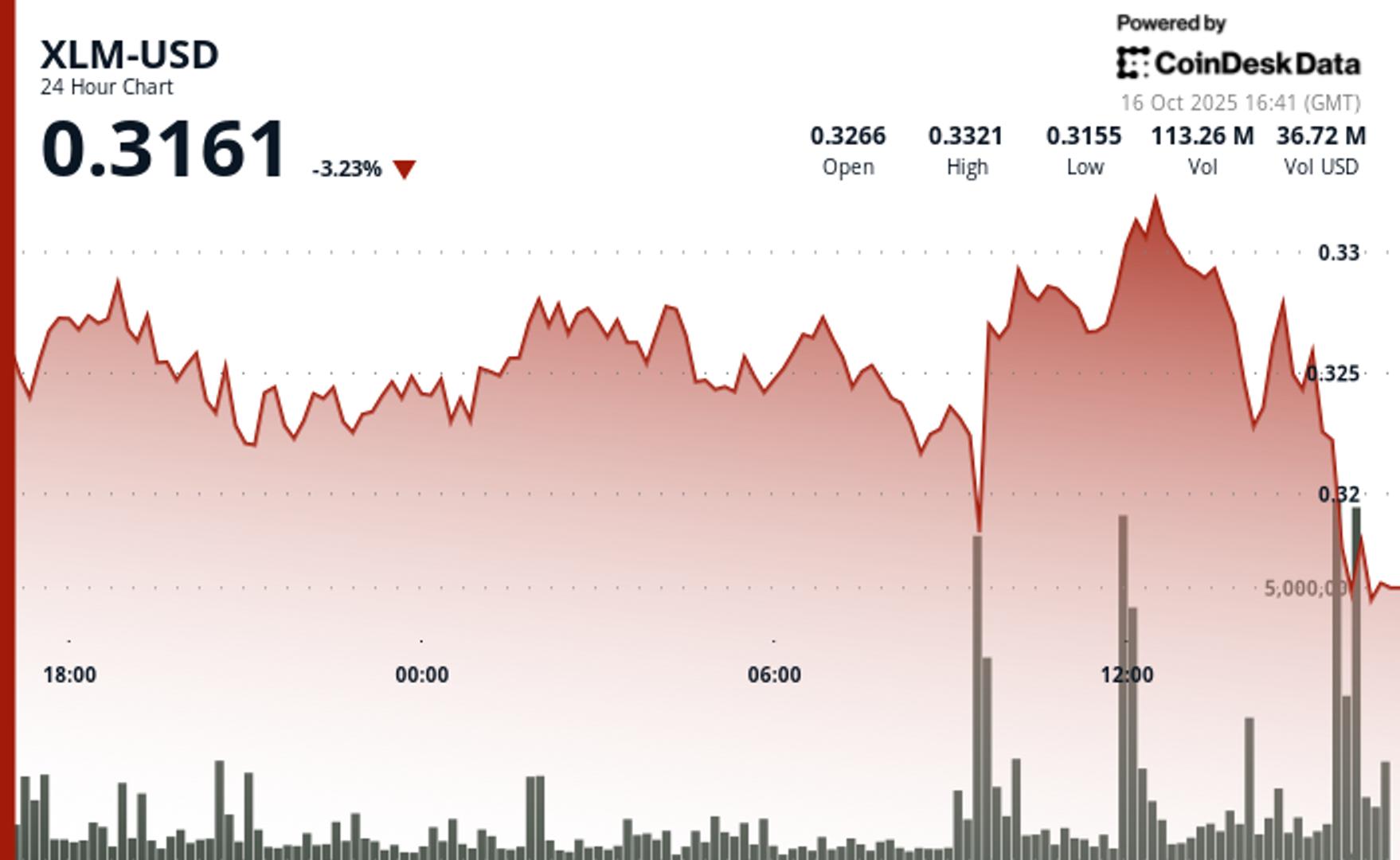

Stellar Slides Late as Volatility Returns Despite Institutional Milestone

NeutralCryptocurrency

WisdomTree has launched Europe's first physically-backed Stellar exchange-traded product, marking a significant milestone in the digital payments landscape. This development comes at a time of increased competition in the sector, highlighting the growing interest and volatility surrounding digital assets. As institutions explore new avenues for investment, this product could pave the way for more mainstream adoption of Stellar and similar cryptocurrencies.

— Curated by the World Pulse Now AI Editorial System