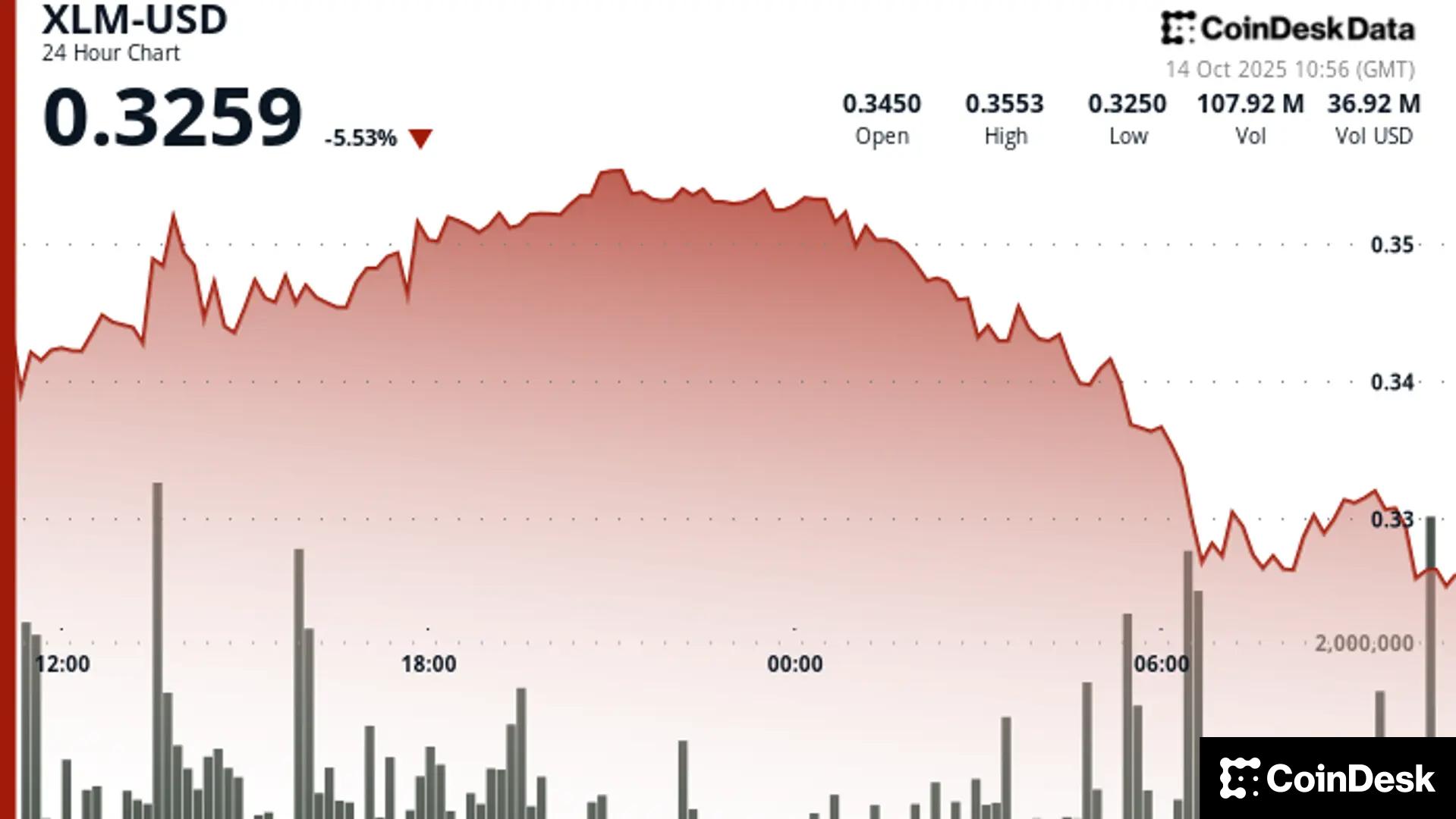

WisdomTree Launches Physically Backed Stellar Lumens ETP Across Europe

PositiveCryptocurrency

WisdomTree has launched a physically backed exchange-traded product (ETP) for Stellar Lumens across Europe, marking a significant step in the cryptocurrency investment landscape. This move not only enhances the accessibility of digital assets for investors but also reflects growing institutional interest in cryptocurrencies. By offering a regulated product, WisdomTree aims to provide a secure and transparent way for investors to gain exposure to Stellar Lumens, potentially paving the way for more innovative financial products in the future.

— Curated by the World Pulse Now AI Editorial System