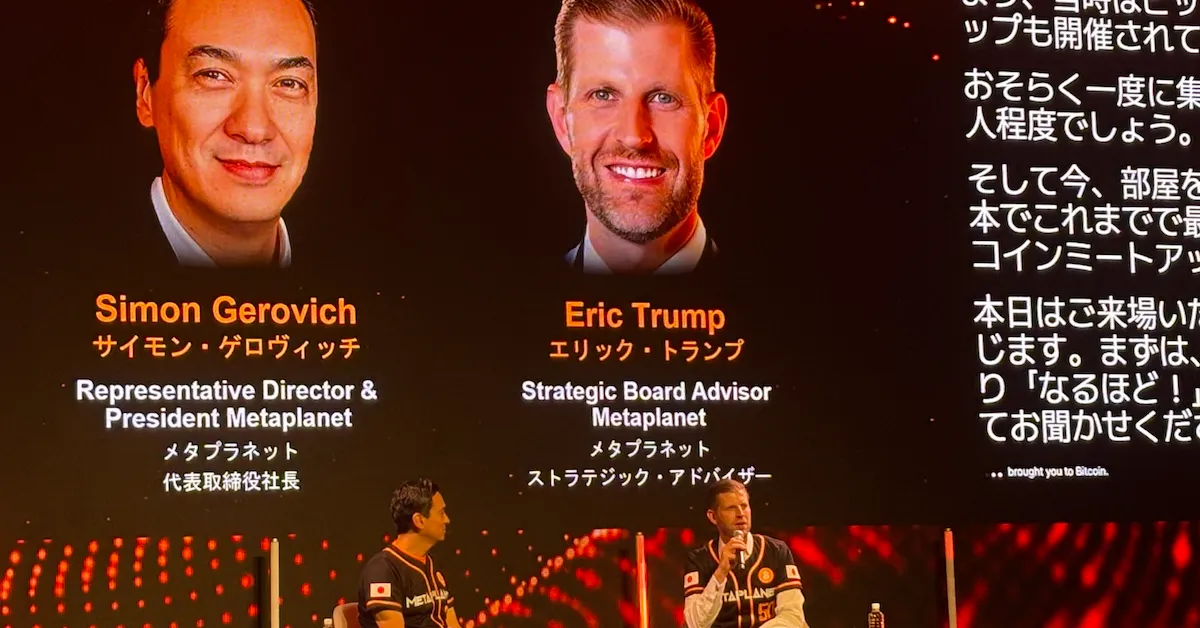

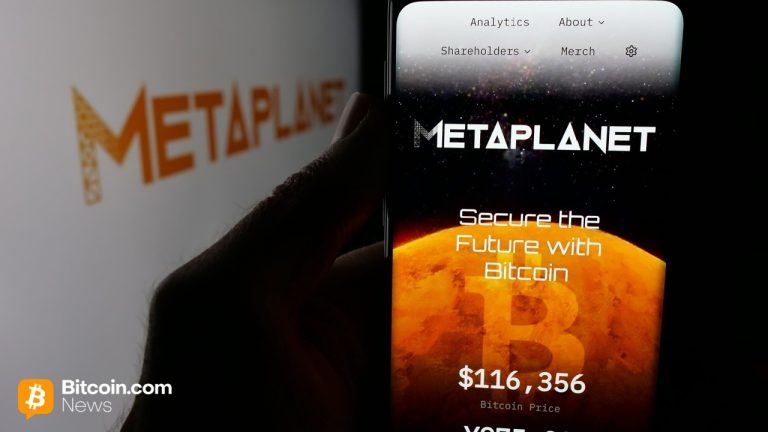

Metaplanet Becomes Fifth-Largest Listed Bitcoin Holder With $632M BTC Buy

PositiveCryptocurrency

Metaplanet has made headlines by becoming the fifth-largest publicly listed holder of Bitcoin after a significant purchase of $632 million in BTC. This move not only positions Metaplanet ahead of its competitor Bullish but also highlights the growing interest and investment in cryptocurrency. As both Metaplanet and Capital B shares experience a downturn, this strategic acquisition could signal a shift in market dynamics and investor confidence in Bitcoin's long-term potential.

— Curated by the World Pulse Now AI Editorial System