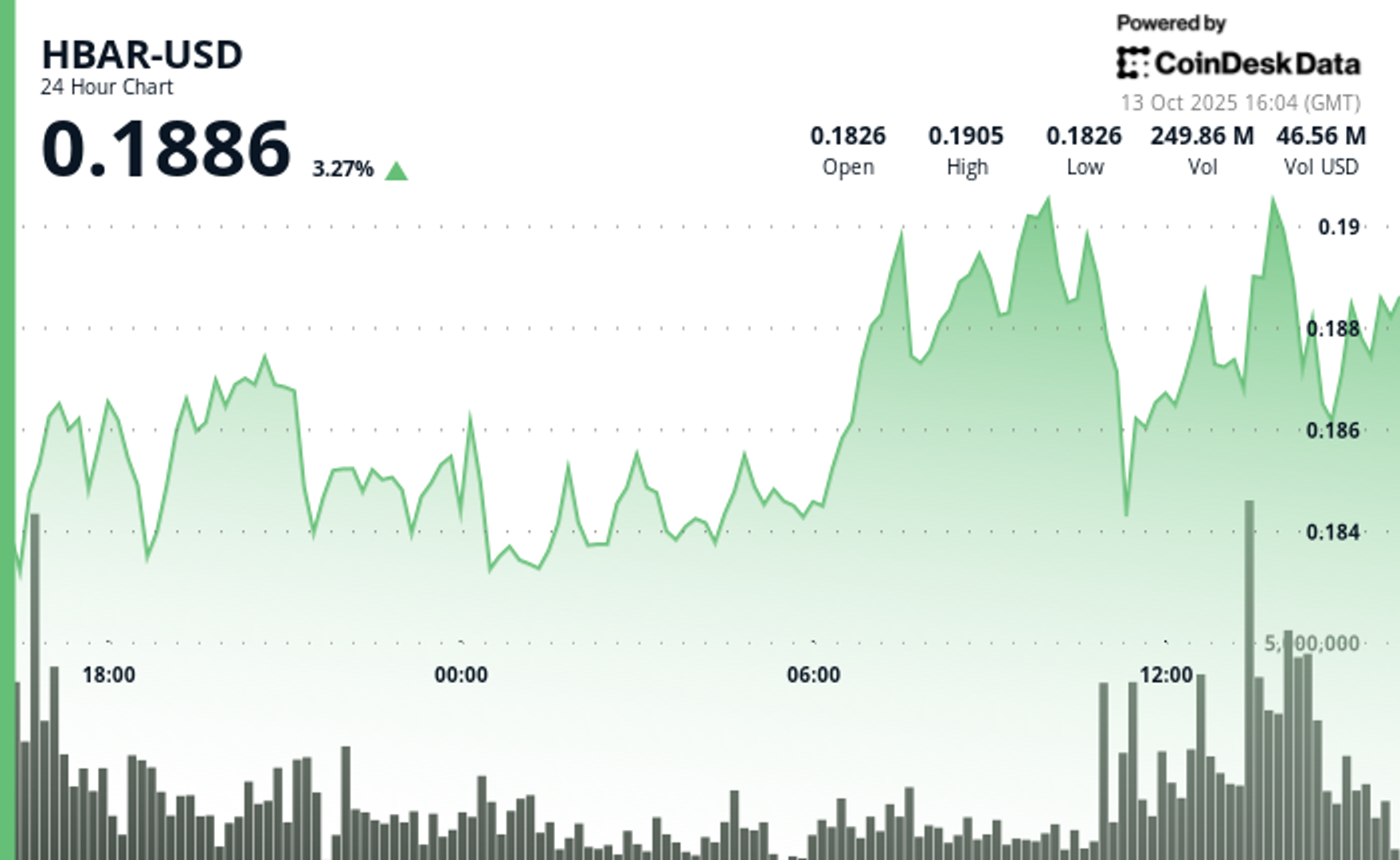

HBAR Rises Past Key Resistance After Explosive Decline

PositiveCryptocurrency

HBAR has recently surged past a significant resistance level after experiencing a sharp decline, signaling a potential recovery in the cryptocurrency market. This rise is noteworthy as it reflects renewed investor confidence and could indicate a broader trend of stabilization in digital assets, making it an important development for traders and enthusiasts alike.

— Curated by the World Pulse Now AI Editorial System