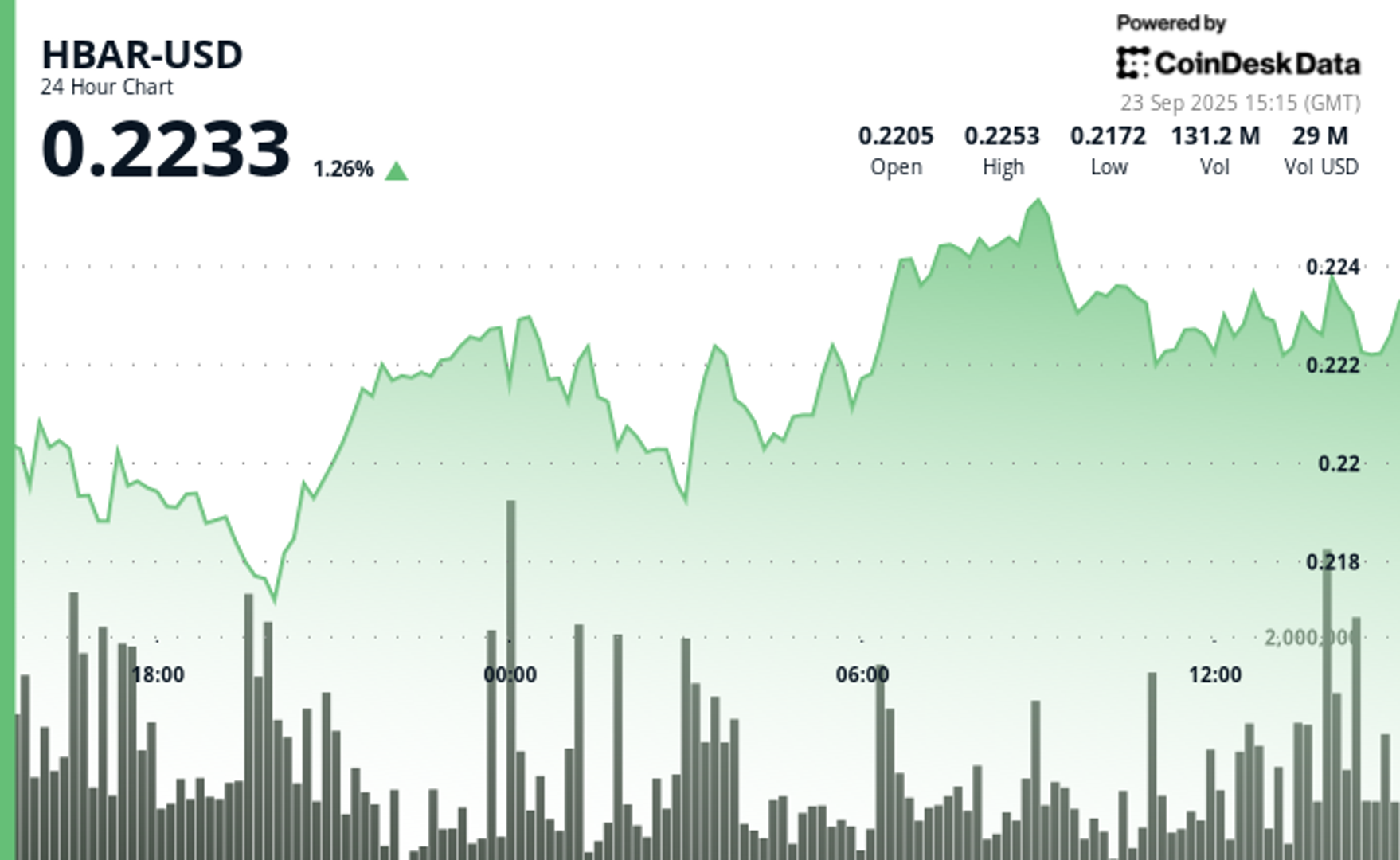

HBAR Surges 3.85% in Volatile Session as Institutional Buying Emerges

PositiveCryptocurrency

HBAR has seen a notable surge of 3.85% during a volatile trading session, driven by increased interest from institutional buyers. This uptick is significant as it reflects growing confidence in the cryptocurrency market, suggesting that larger investors are starting to recognize the potential of HBAR. Such movements can indicate a shift in market dynamics, potentially leading to more stability and interest in digital assets.

— Curated by the World Pulse Now AI Editorial System