US Government May Have Quietly Seized Another $2.4B in Bitcoin Linked to Lubian Mining Pool

NeutralCryptocurrency

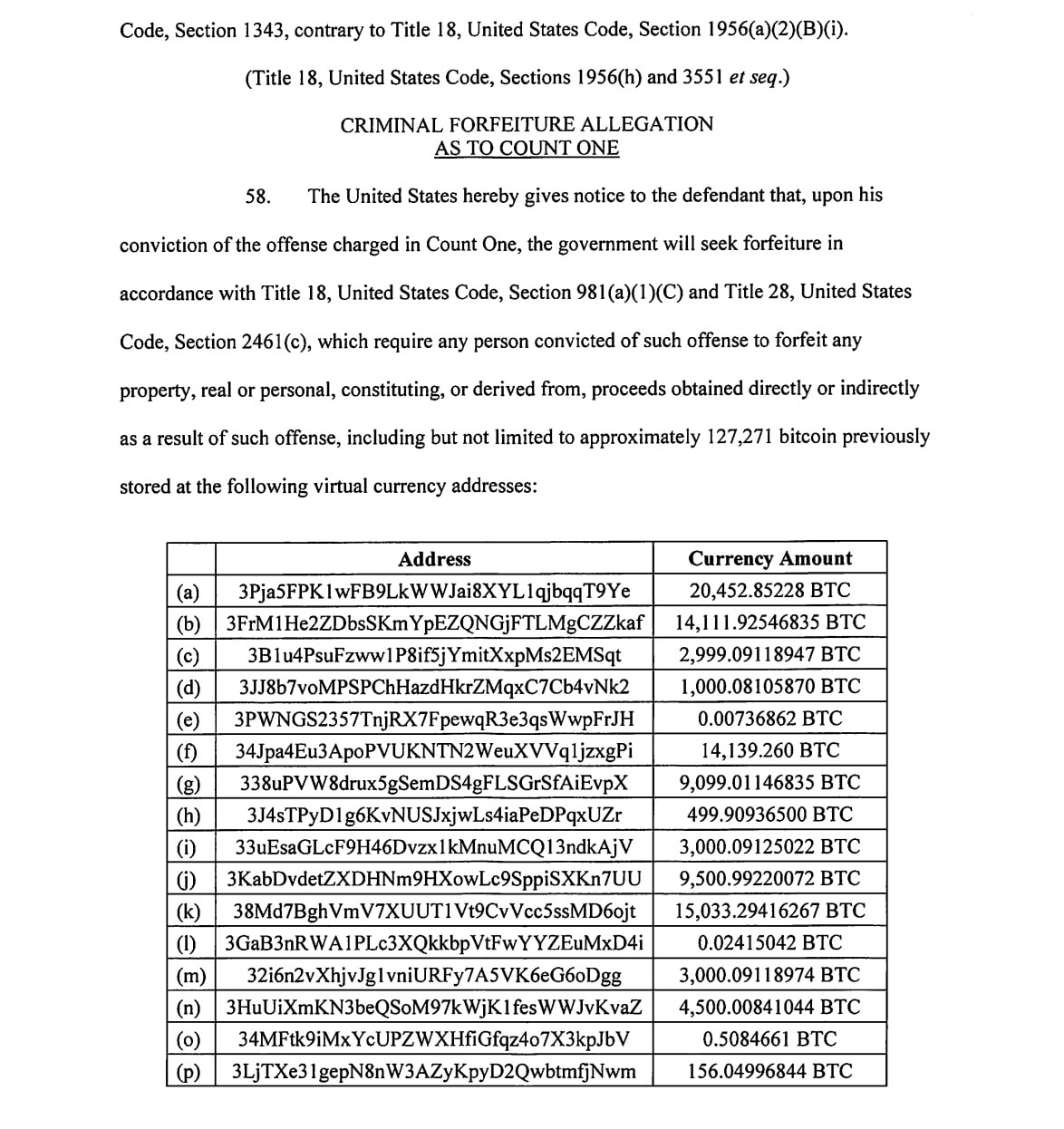

The US government may have quietly seized an additional $2.4 billion in Bitcoin linked to the Lubian Mining Pool. This development is significant as it highlights ongoing efforts by authorities to crack down on illicit cryptocurrency activities. The seizure reflects the government's commitment to regulating the crypto space and ensuring compliance with financial laws, which could have broader implications for the market and investors.

— Curated by the World Pulse Now AI Editorial System