Can Litecoin price reclaim $200 amid ETF hype as a key resistance zone approaches?

PositiveCryptocurrency

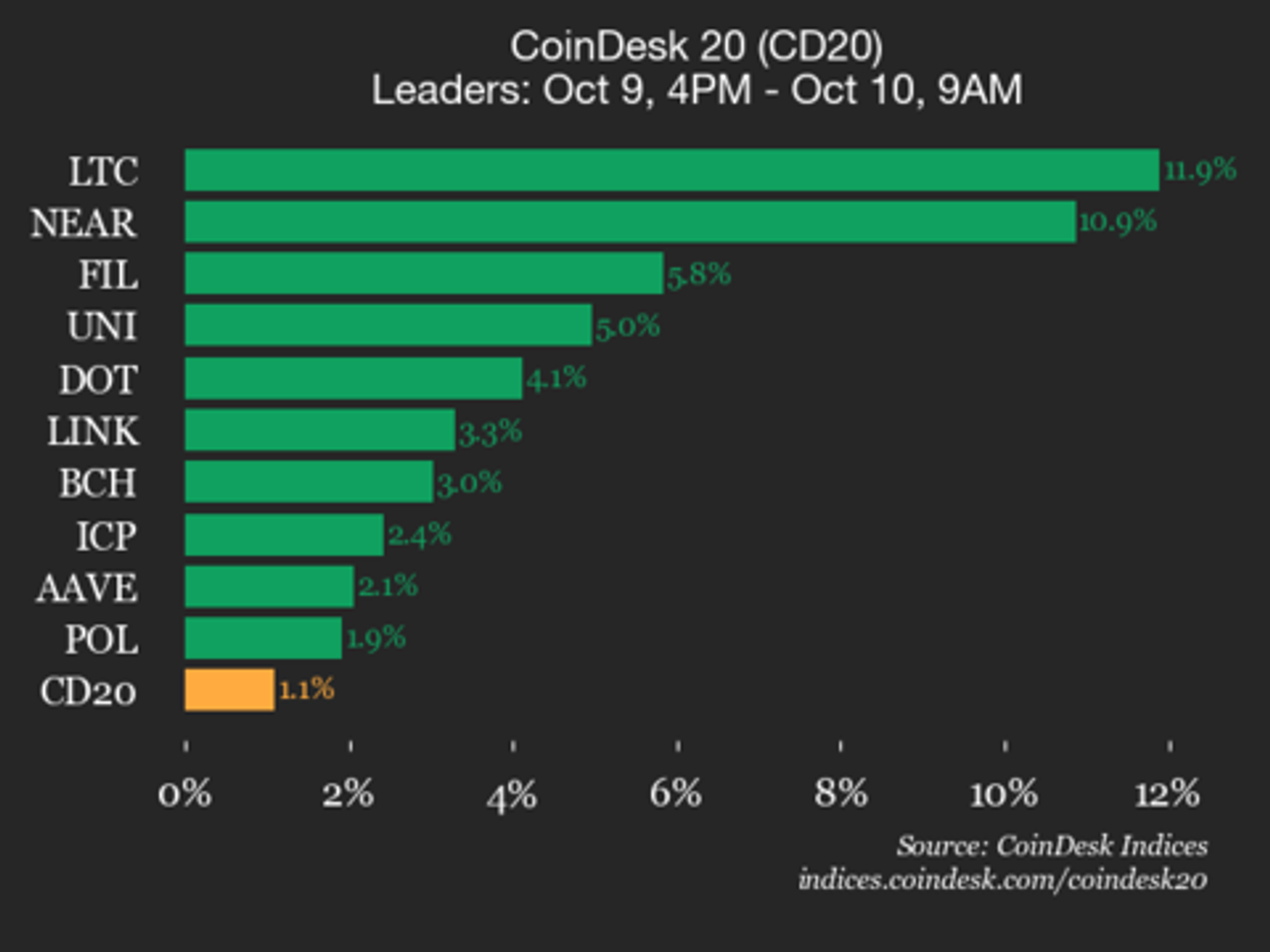

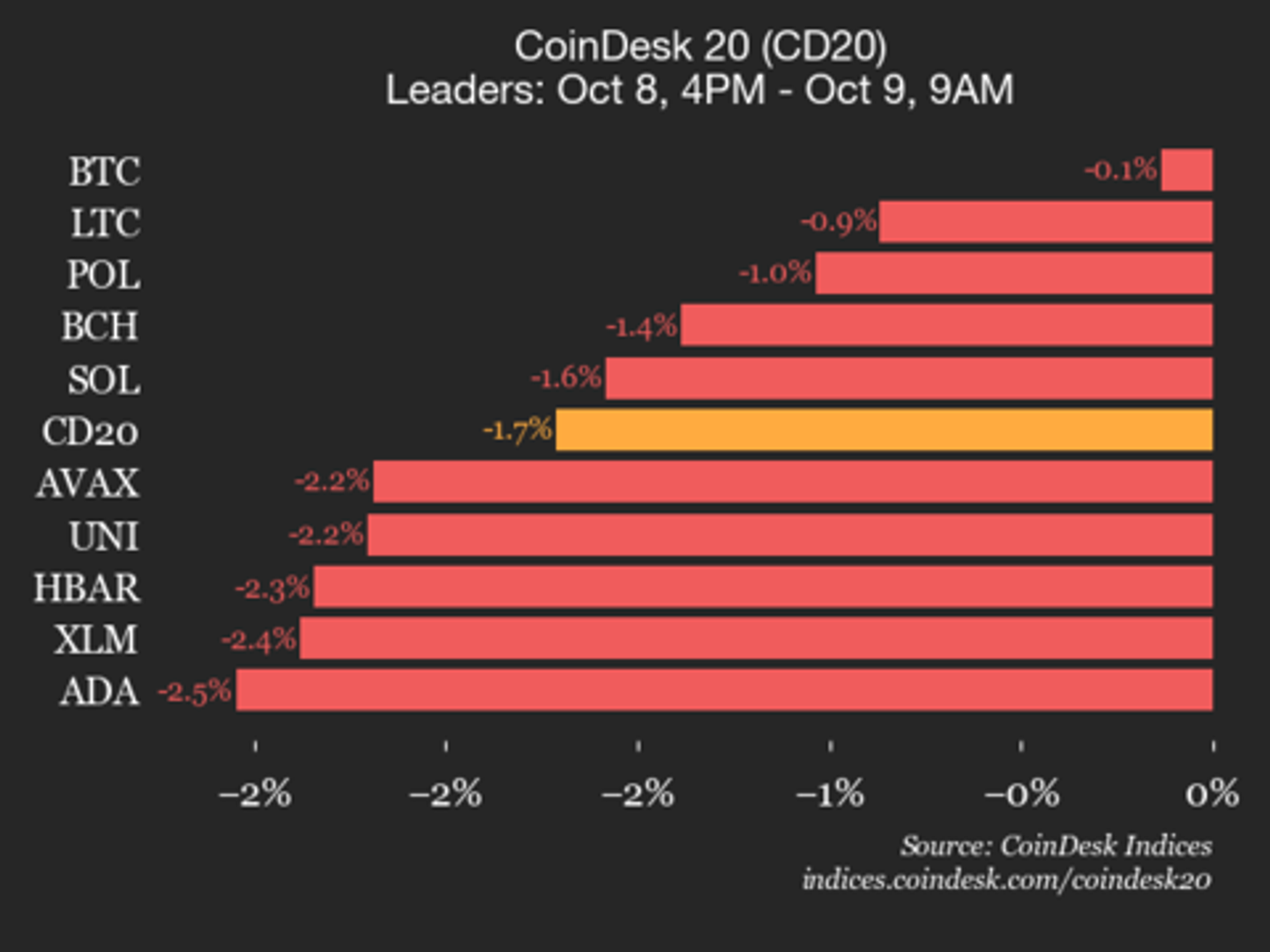

Litecoin has surged to an 8-week high of $132, nearing a crucial resistance level that, if surpassed, could propel its price towards $200 in the near future. This rally is significant as it reflects growing investor interest and optimism surrounding Litecoin, particularly in light of recent ETF discussions that could further boost its market presence.

— Curated by the World Pulse Now AI Editorial System