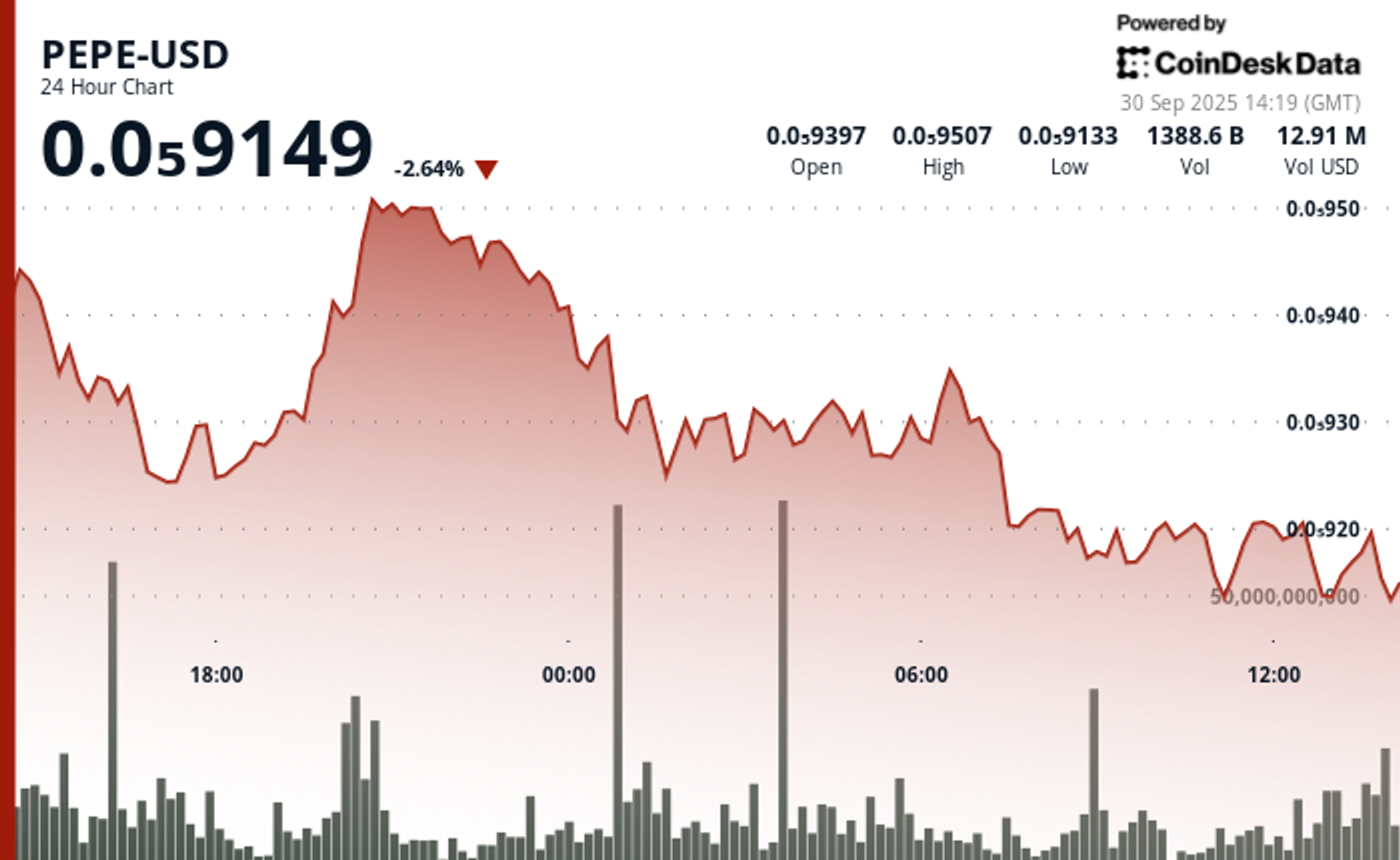

Monthly perp trading surpass $1t for the first time

PositiveCryptocurrency

In a historic milestone, perpetual trading on decentralized exchanges (DEXs) exceeded $1 trillion in September, marking a significant moment for the DeFi space. This surge, reaching $1.14 trillion, highlights the growing interest and participation in perpetual contracts, which allow traders to speculate on price movements without owning the underlying asset. This development is crucial as it reflects the increasing maturity and adoption of decentralized finance, potentially attracting more investors and enhancing market liquidity.

— Curated by the World Pulse Now AI Editorial System