Sharps Technology expands Solana digital asset treasury strategy with Coinbase

PositiveCryptocurrency

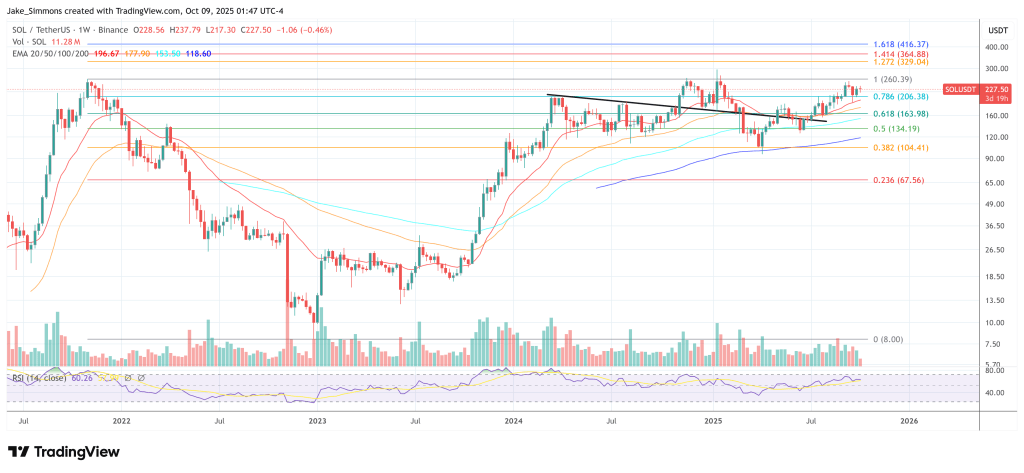

Sharps Technology is making waves by expanding its digital asset treasury strategy with Solana and Coinbase, showcasing a significant shift in how traditional firms are engaging with cryptocurrencies. This move not only reflects the growing acceptance of digital assets but also highlights the potential for increased shareholder value, making it a noteworthy development in the financial landscape.

— Curated by the World Pulse Now AI Editorial System