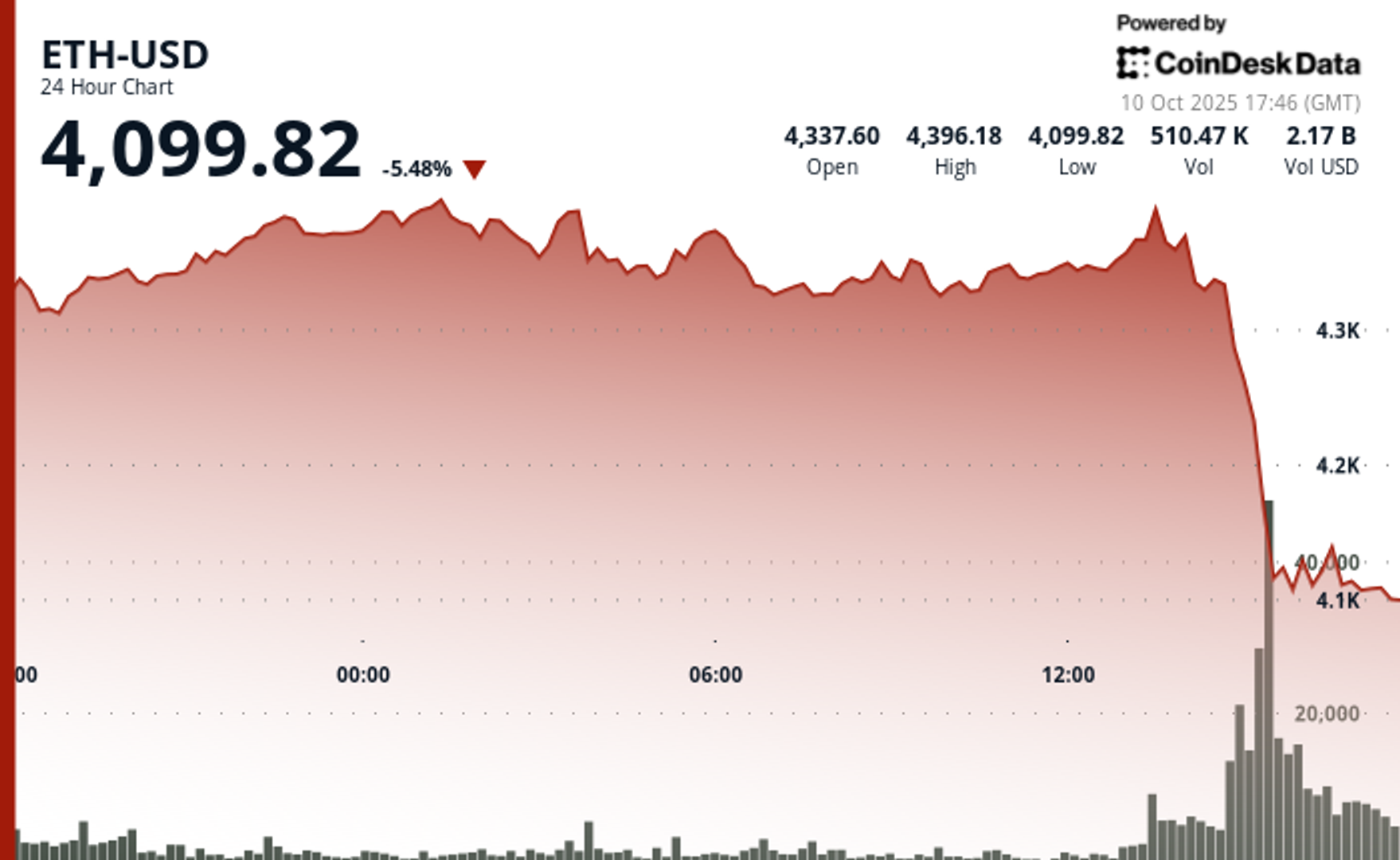

Six global policy changes that affected crypto this week

NeutralCryptocurrency

This week, significant policy changes around the globe have started to reshape the crypto industry, influencing how businesses and investors navigate this evolving landscape. Understanding these changes is crucial as they could impact regulations, market dynamics, and the overall future of cryptocurrencies.

— Curated by the World Pulse Now AI Editorial System