CleanSpark secures second BTC-backed credit line this week without share dilution

PositiveCryptocurrency

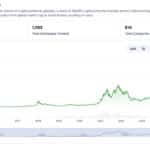

CleanSpark has successfully secured a second Bitcoin-backed credit line worth $100 million from Two Prime this week, bringing its total borrowing capacity to an impressive $400 million. This significant financial boost is set to enhance CleanSpark's data center operations and expand its hashrate capabilities, which is crucial for its growth in the competitive cryptocurrency market. This development not only reflects CleanSpark's strong position in the industry but also highlights the increasing confidence in Bitcoin-backed financing.

— Curated by the World Pulse Now AI Editorial System