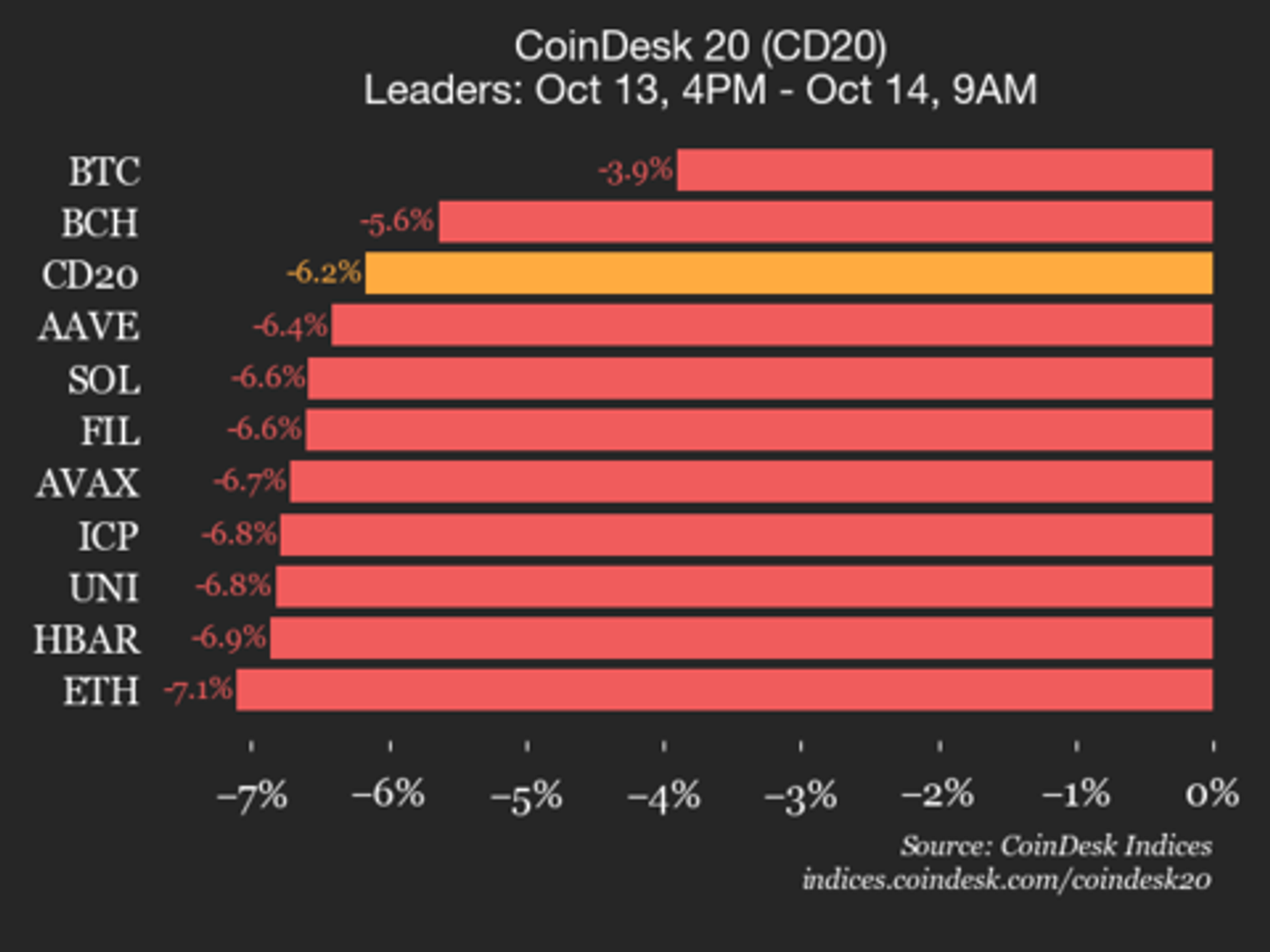

CoinDesk 20 Performance Update: Internet Computer (ICP) Drops 3.5% as Index Declines

NegativeCryptocurrency

The latest CoinDesk 20 performance update reveals that Internet Computer (ICP) has experienced a 3.5% decline, contributing to a broader downturn in the index. This drop is significant as it reflects ongoing volatility in the cryptocurrency market, which can impact investor confidence and market dynamics. Understanding these fluctuations is crucial for investors and enthusiasts alike, as they navigate the complexities of digital assets.

— Curated by the World Pulse Now AI Editorial System