POL Price Prediction: Can Polygon Recover After Blockchain Payments Consortium (BPC) News Hits Market Sentiment?

NegativeCryptocurrency

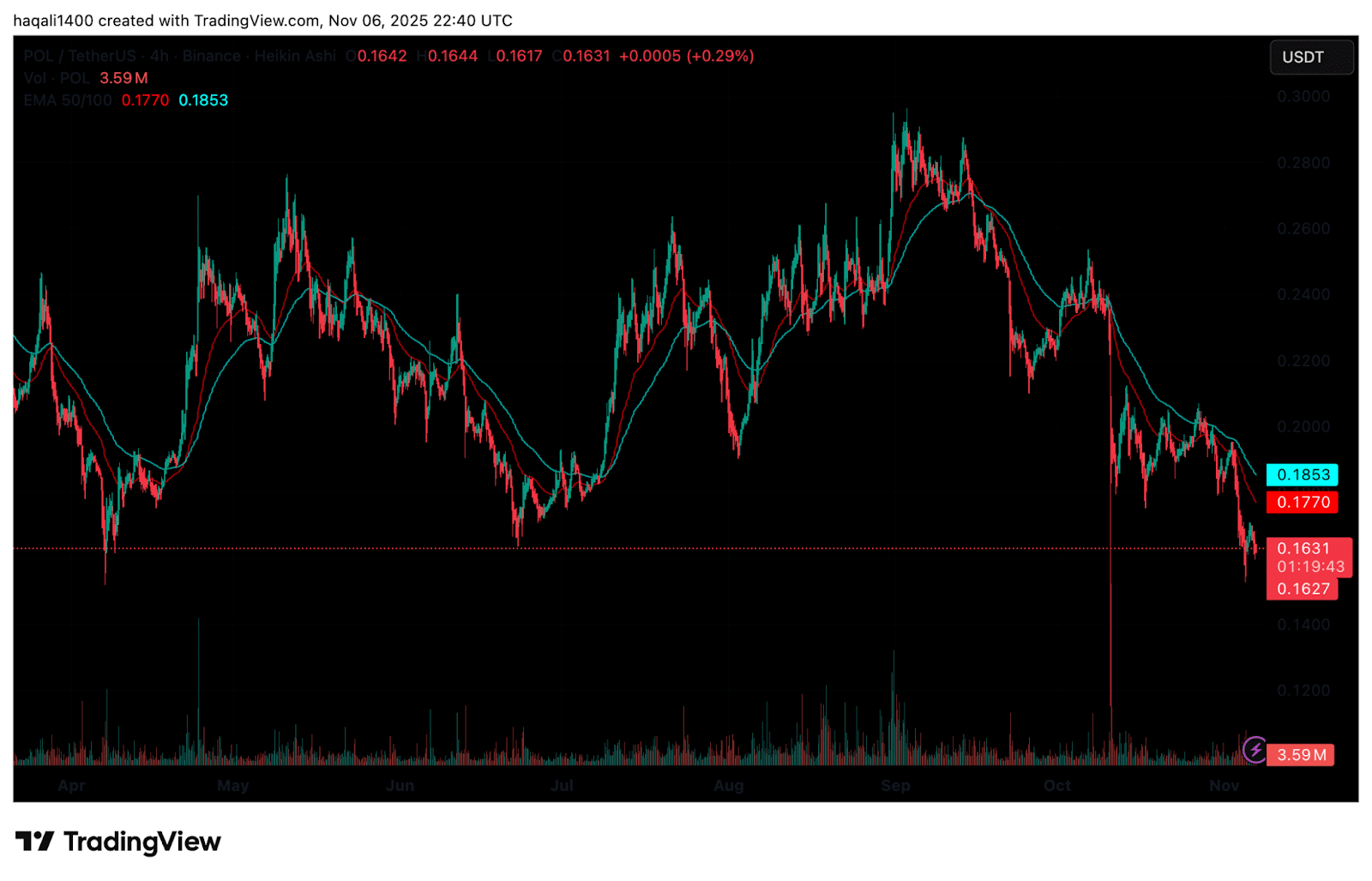

Polygon's native token, POL, has experienced a decline in value following news about a payments consortium that has shifted market sentiment. As traders evaluate the implications of this development on on-chain usage, POL's price fell to around $0.164. This situation is significant as it highlights the volatility in the cryptocurrency market and the impact of external news on digital asset valuations.

— via World Pulse Now AI Editorial System

![[LIVE] Crypto News Today, November 7 – Bitcoin Tries To Stay Above $100K While Privacy Coins Like ZCASH (ZEC) and Monero (XMR) Surge: Best Crypto To Buy?](https://dummyimage.com/600x400/1a4a3b/ffffff.png&text=World Pulse Now)