XRP price faces correction risk as new sell signal tests recent uptrend

NeutralCryptocurrency

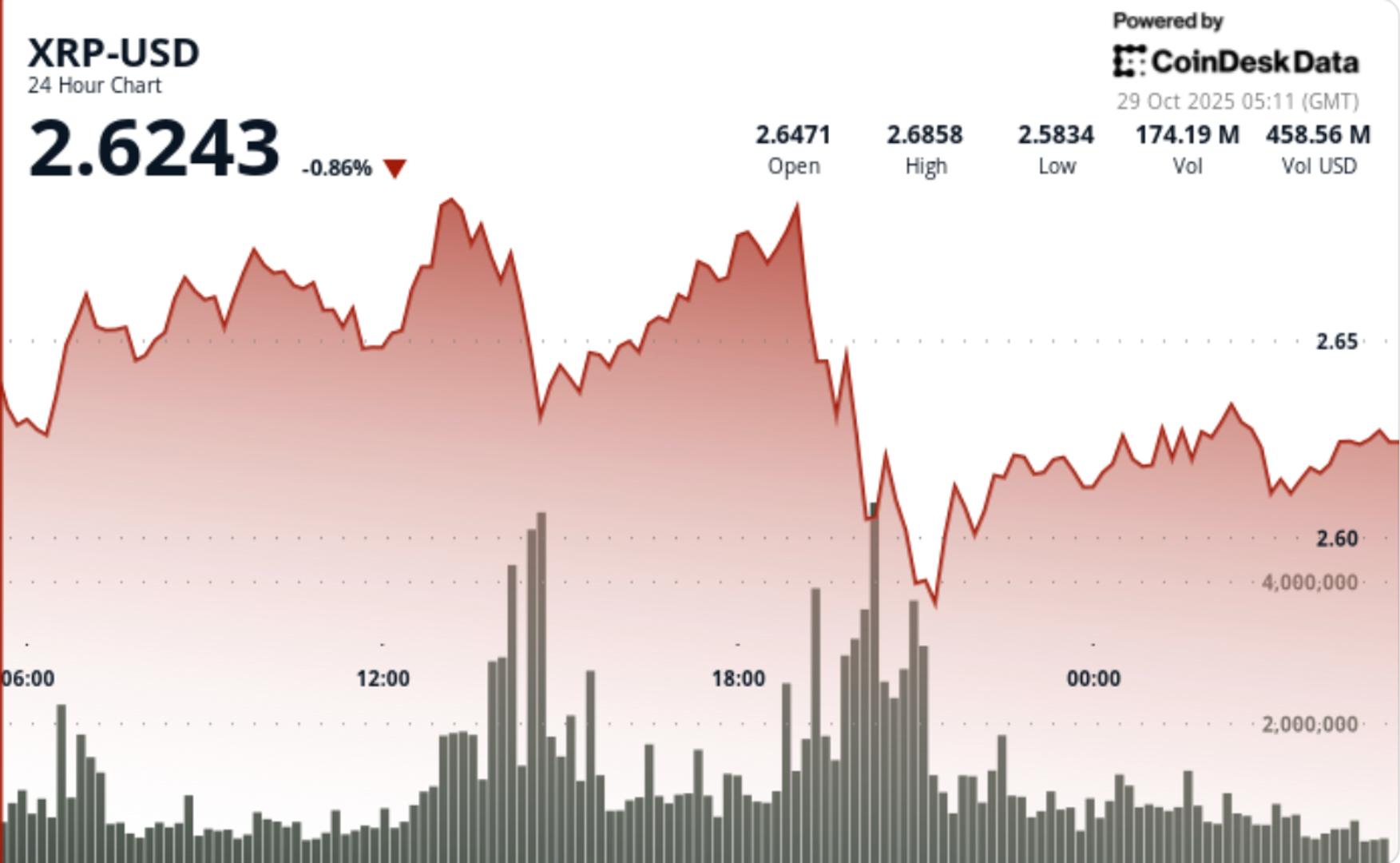

XRP's price is currently stable around $2.60, but it faces potential correction risks as a significant sell signal emerges, testing the strength of its recent rally. Despite a slight decline of 0.4% in the last 24 hours, market confidence remains bolstered by the presence of large investors, known as whales, and the anticipation of possible exchange-traded fund approvals. This situation is crucial as it could influence the future trajectory of XRP and the broader cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System