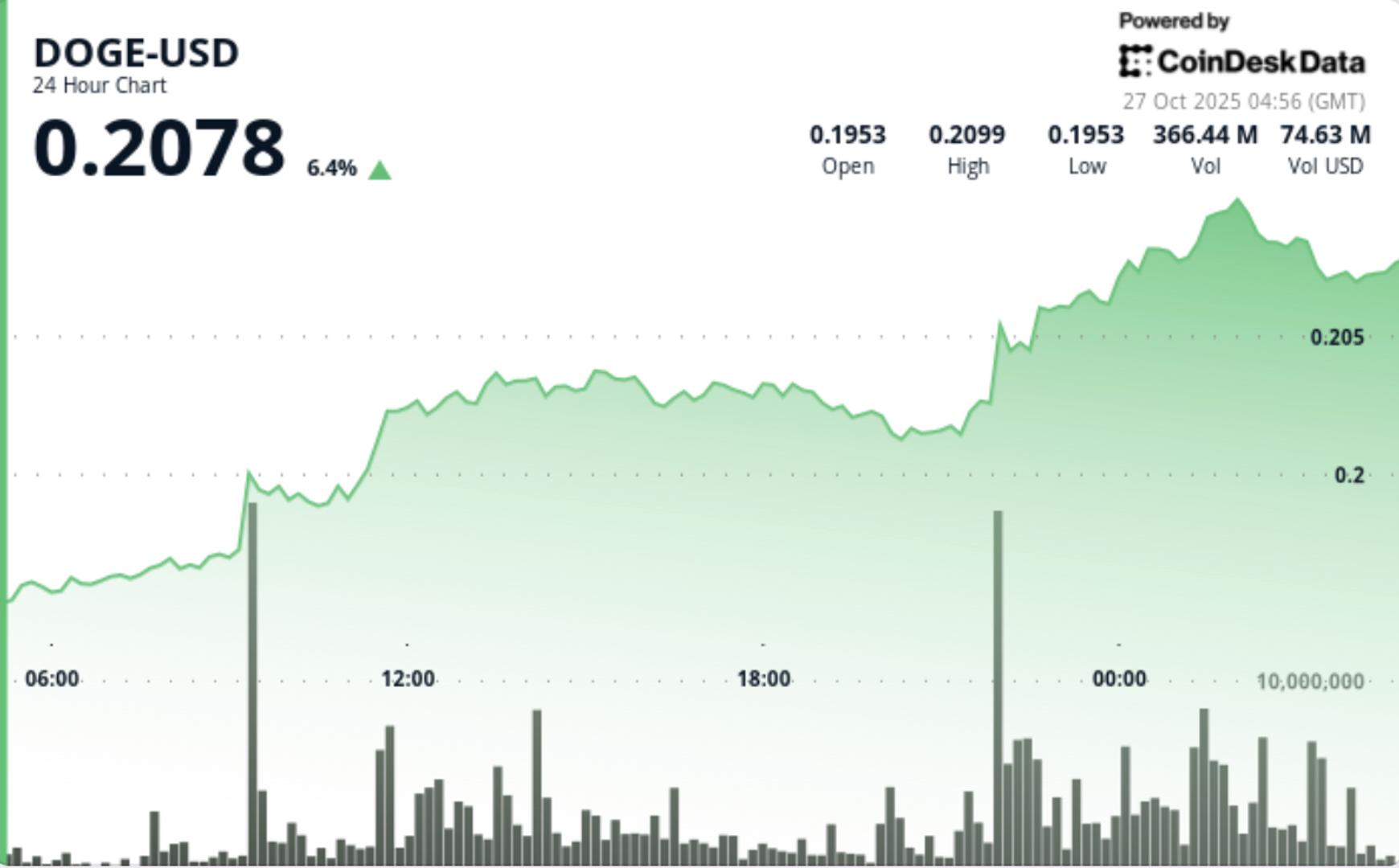

Dogecoin Breaks Multi-Month Range as $0.21 Resistance Flips to Support

PositiveCryptocurrency

Dogecoin has recently broken through a multi-month price range, with the $0.21 resistance level now acting as support. This shift is significant as it indicates growing confidence among investors and could lead to further price increases. The change in market dynamics suggests that Dogecoin may be gaining traction, which is important for both traders and the broader cryptocurrency community.

— Curated by the World Pulse Now AI Editorial System