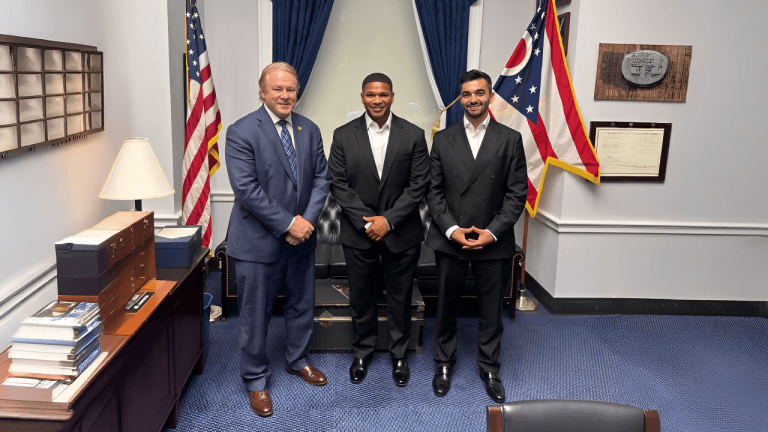

Senators Seek Industry Input on Crypto Payments Bill as Lumia Shares Insights

PositiveCryptocurrency

Senators are actively seeking input from the industry on a new crypto payments bill, with insights from Lumia highlighting the importance of regulatory clarity. This initiative is crucial as it aims to create a framework that could foster innovation while ensuring consumer protection in the rapidly evolving digital currency landscape.

— Curated by the World Pulse Now AI Editorial System