Dormant Bitcoin Awakens Amid Selloff: 1,401 BTC (2–3 Years Old) Moves Overnight

NegativeCryptocurrency

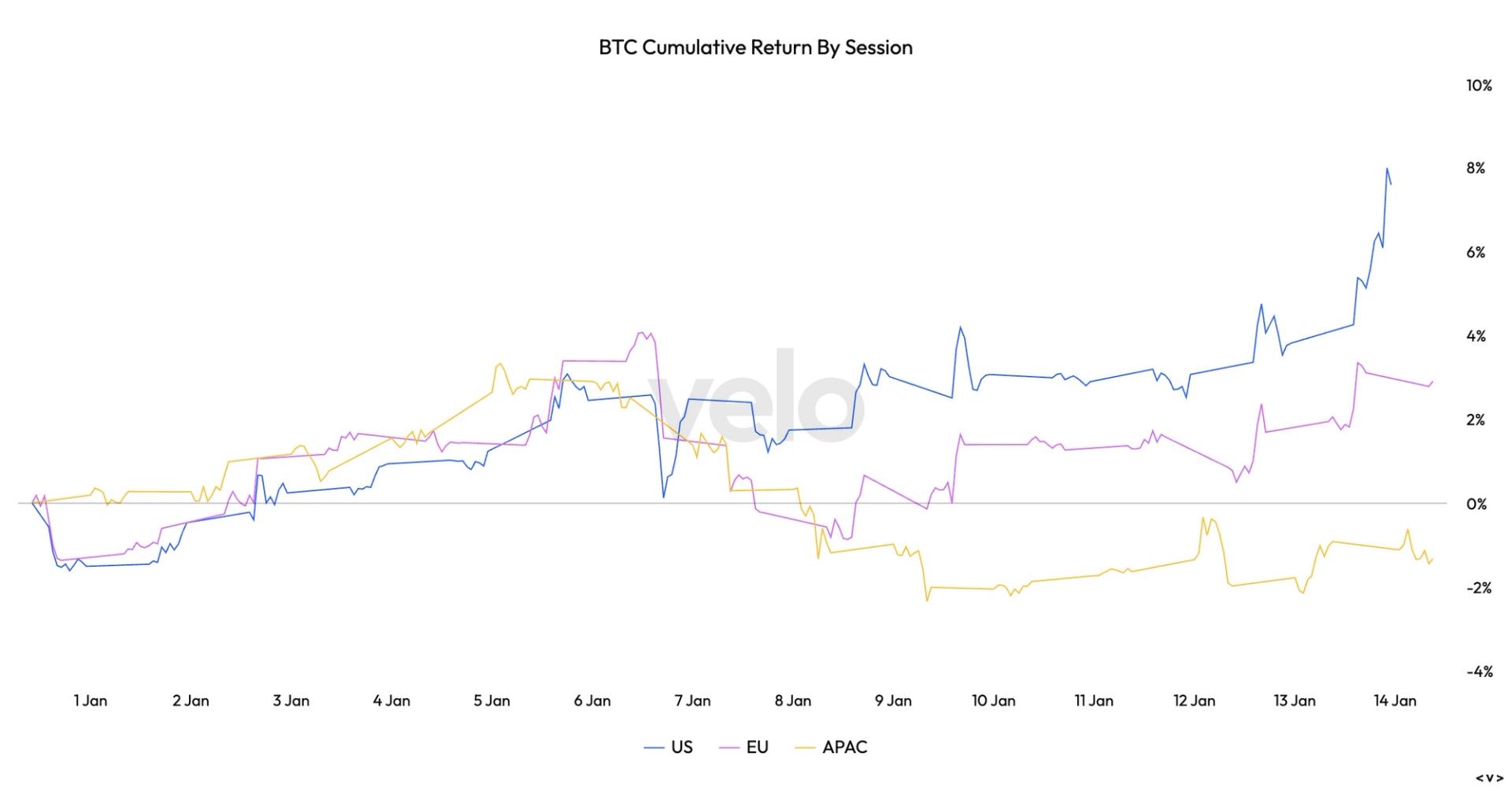

The recent selloff in the Bitcoin market has raised concerns as 1,401 BTC, dormant for 2 to 3 years, moved overnight. This shift comes as Bitcoin struggles to maintain support after losing the crucial $115,000 level, indicating increased volatility and uncertainty. Analysts suggest that while this may shake confidence, it could also signal a new phase in the crypto cycle, making it a critical moment for investors to watch.

— via World Pulse Now AI Editorial System