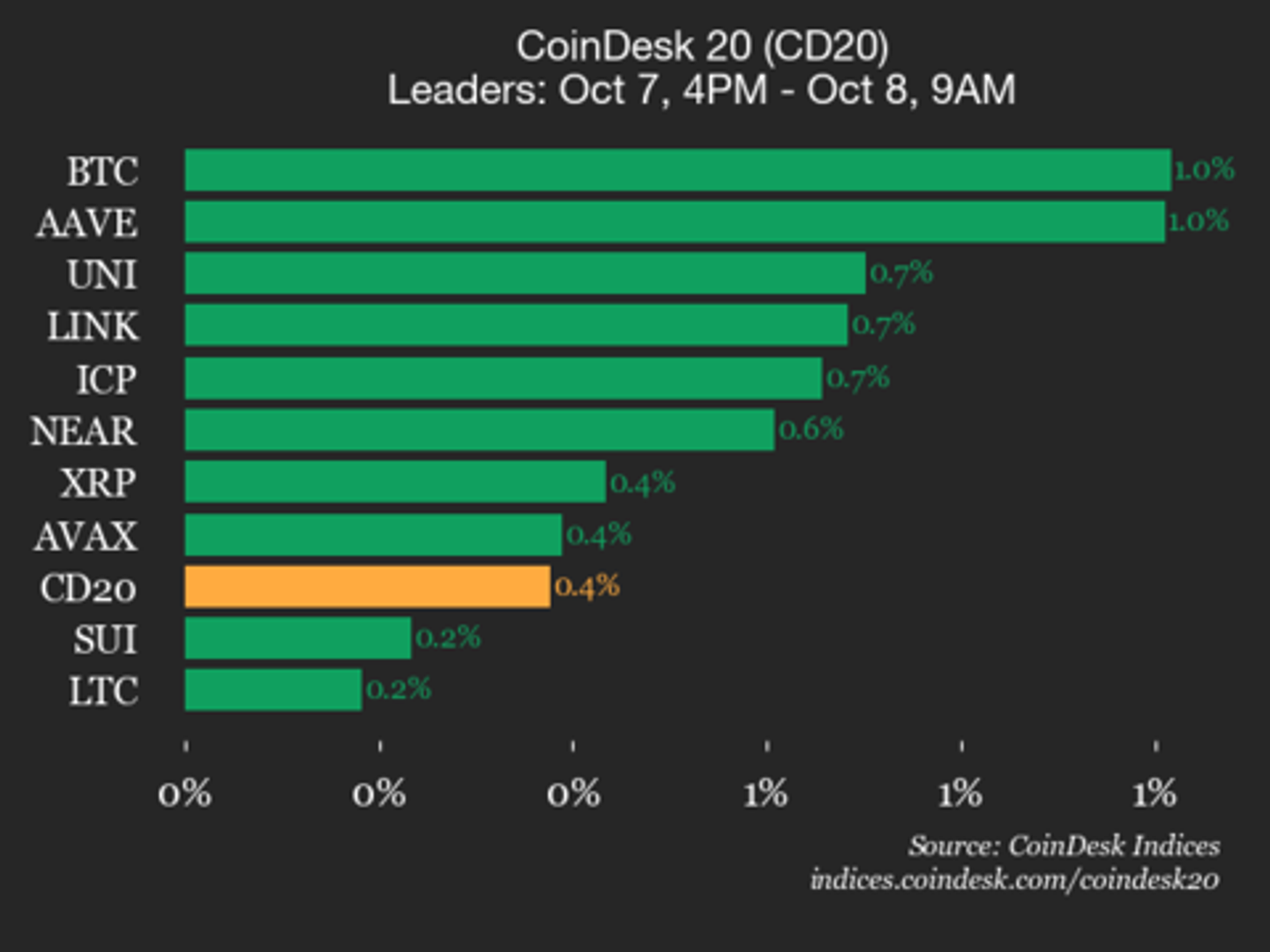

CoinDesk 20 Performance Update: Bitcoin (BTC) Rises 1%, Leading Index Higher

PositiveCryptocurrency

Bitcoin has seen a 1% increase, leading the CoinDesk 20 index higher. This rise is significant as it reflects growing investor confidence in cryptocurrencies, particularly in Bitcoin, which often sets the tone for the market. As more investors turn to digital assets, this upward trend could indicate a broader recovery in the crypto space, making it an important development for both seasoned investors and newcomers.

— Curated by the World Pulse Now AI Editorial System