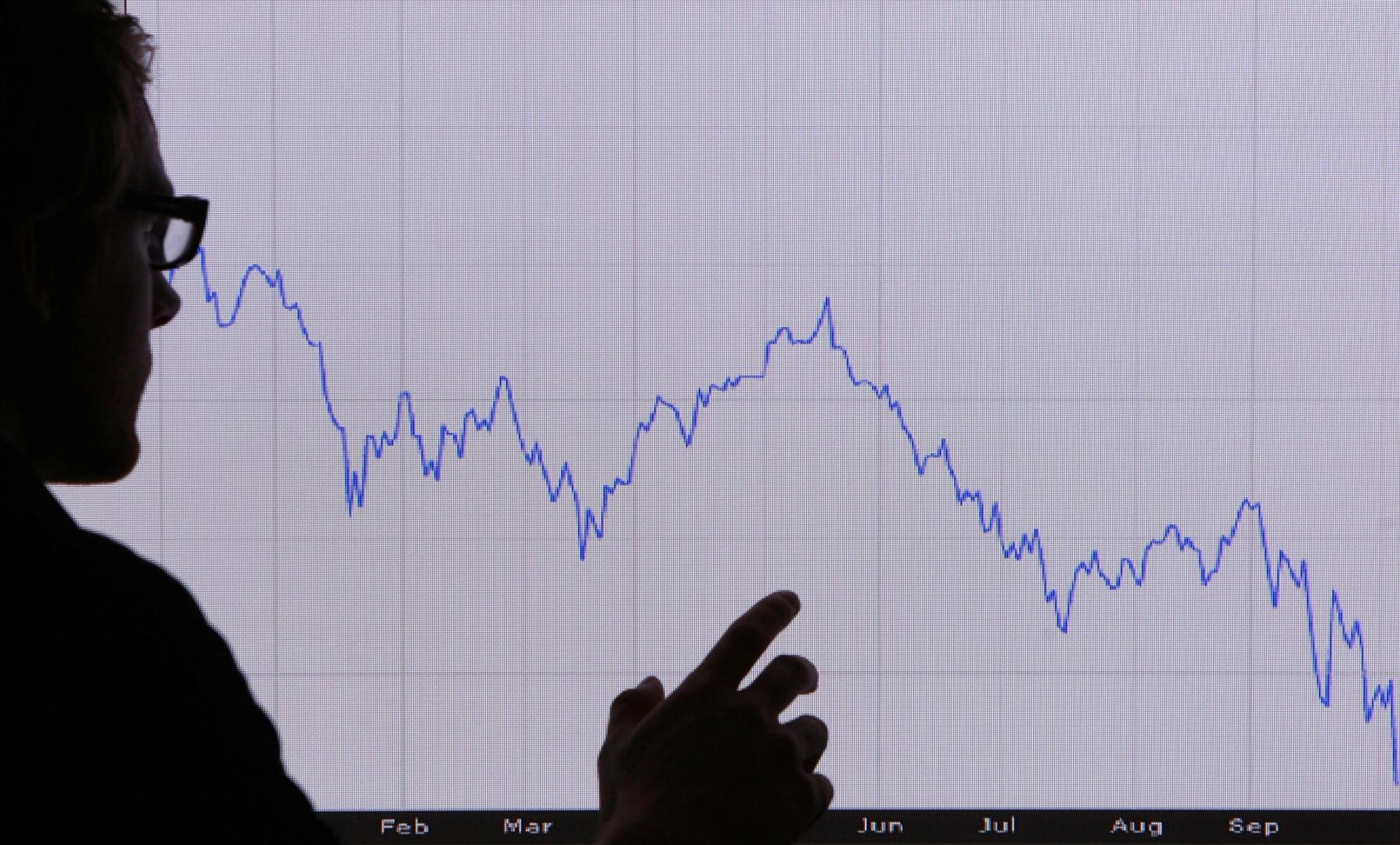

Forget Bitcoin’s Halving — The ‘Business Cycle’ Is The Real Market Killer: Analyst

PositiveCryptocurrency

Bitcoin has seen a notable increase of about 4% recently, trading close to $110,000. This uptick is encouraging for both short-term traders and long-term holders, especially as easing tensions between the US and China could positively impact risk assets like Bitcoin. Analysts suggest that a break above $112,200 could signal further strength in the market, making this a crucial moment for investors to watch.

— Curated by the World Pulse Now AI Editorial System