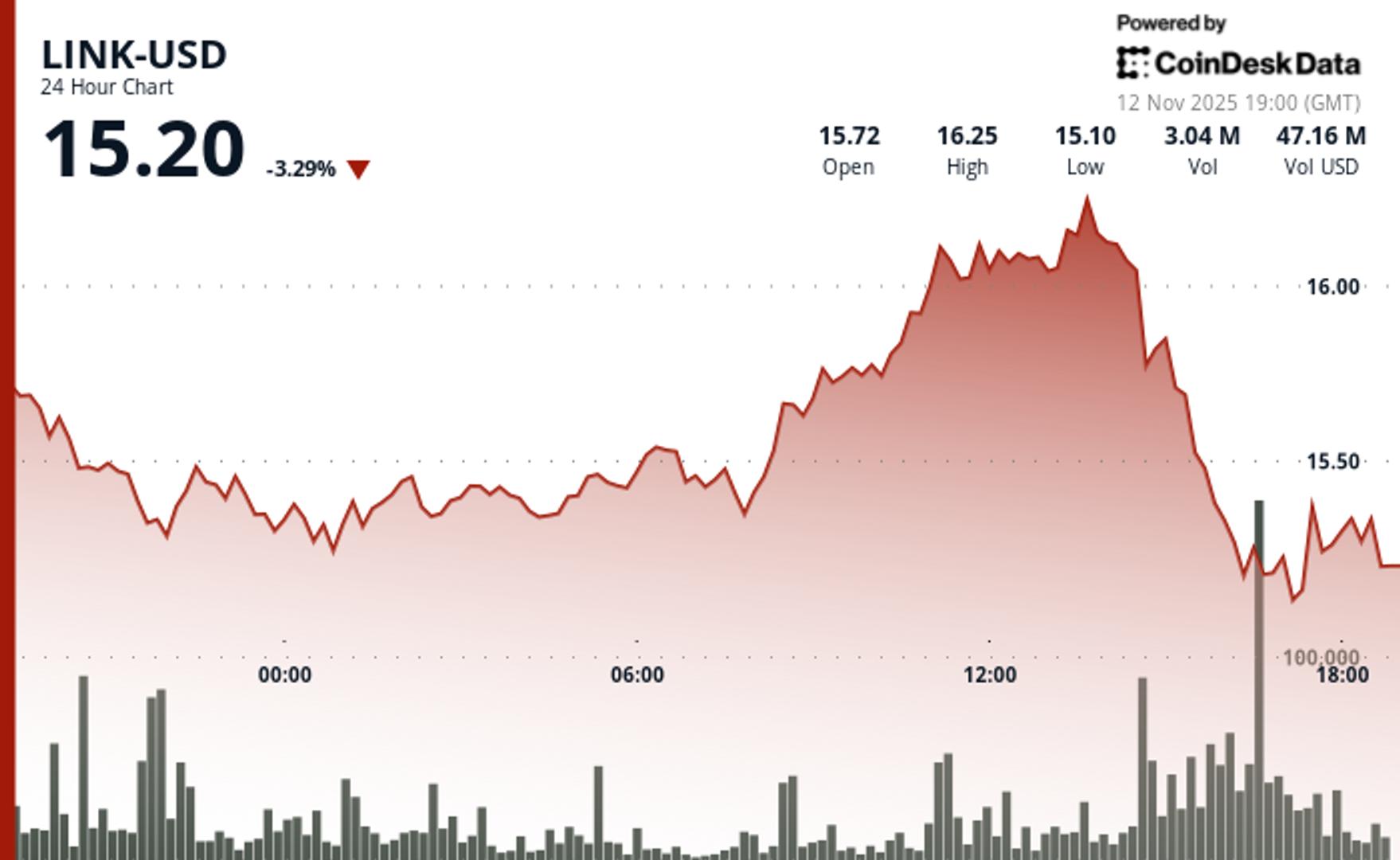

LINK Drops 4% as Chainlink ETF News Fails to Push Break of Technical Resistance

NegativeCryptocurrency

On November 12, 2025, Chainlink's LINK token experienced a 4% decline, settling at $16.25. This drop occurred alongside a significant downturn in the overall cryptocurrency market, indicating a challenging environment for digital assets. Despite expectations that recent ETF news would bolster LINK's performance, it failed to break through key technical resistance levels. This situation underscores the volatility and unpredictability of the crypto market, where external news often does not translate into immediate positive outcomes for specific tokens. The broader market conditions, characterized by a decline, further complicate the landscape for Chainlink and similar cryptocurrencies, as investors remain cautious amid fluctuating prices.

— via World Pulse Now AI Editorial System