XRP rises towards $3 as early Ripple employee steps away from leadership

NeutralCryptocurrency

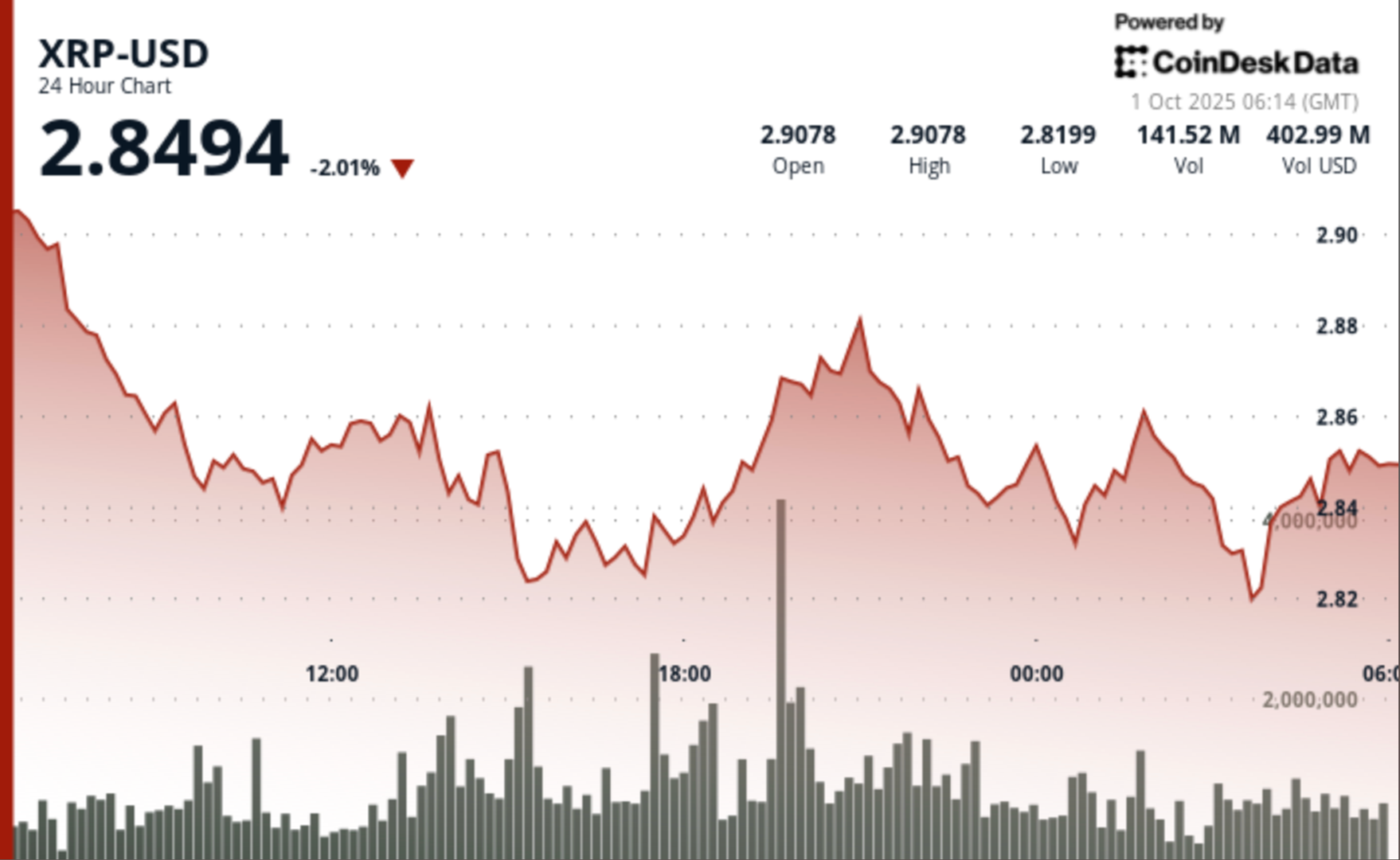

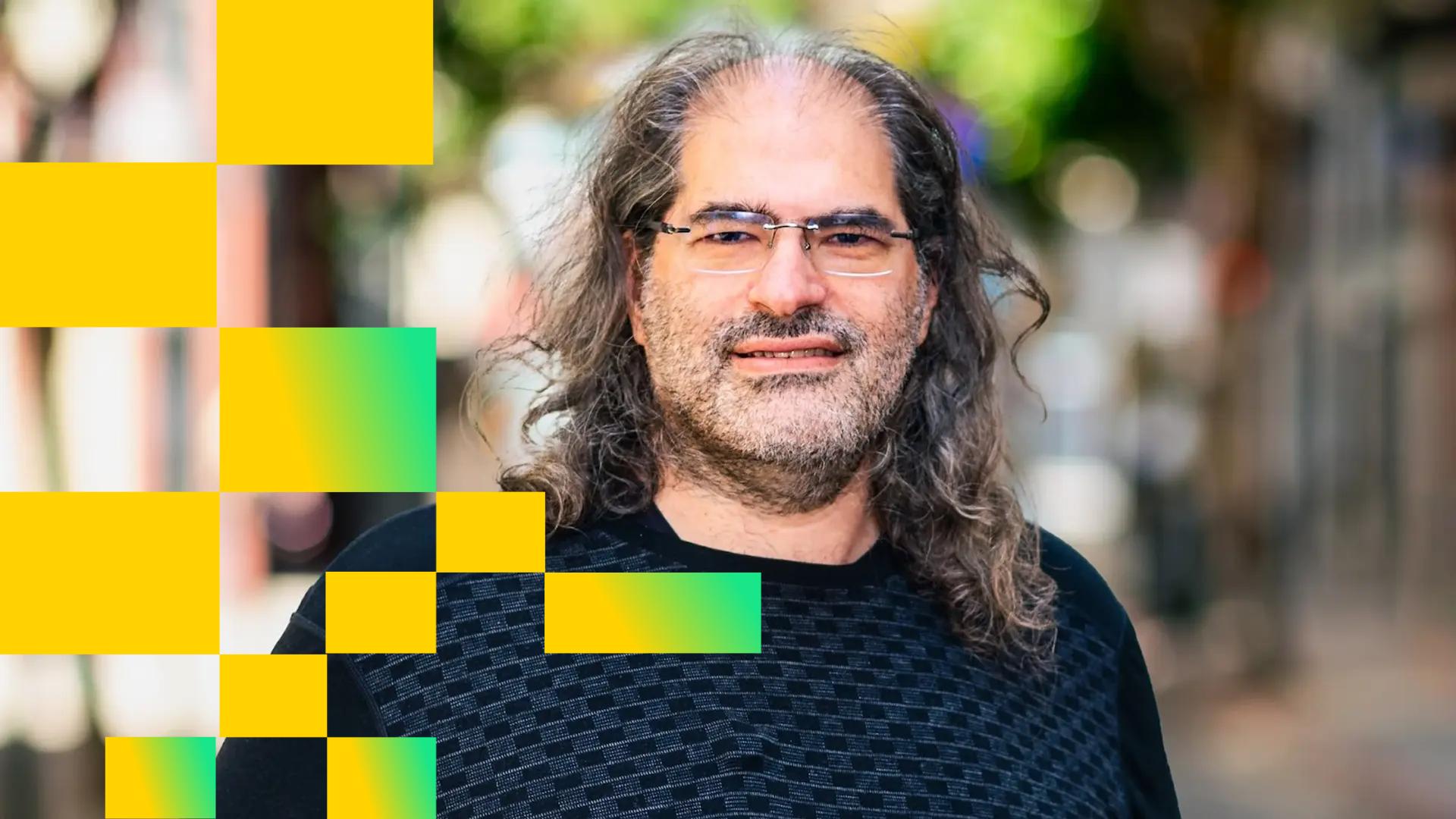

David Schwartz, a key figure at Ripple, has announced his resignation as Chief Technology Officer after over thirteen years. This change comes as XRP's value approaches $3, reflecting the ongoing interest and volatility in the cryptocurrency market. Schwartz's departure marks a significant shift for Ripple, a company that has been pivotal in the development of blockchain technology and digital currencies. His influence in the XRP community has been substantial, and this transition could impact the company's future direction and the broader crypto landscape.

— Curated by the World Pulse Now AI Editorial System