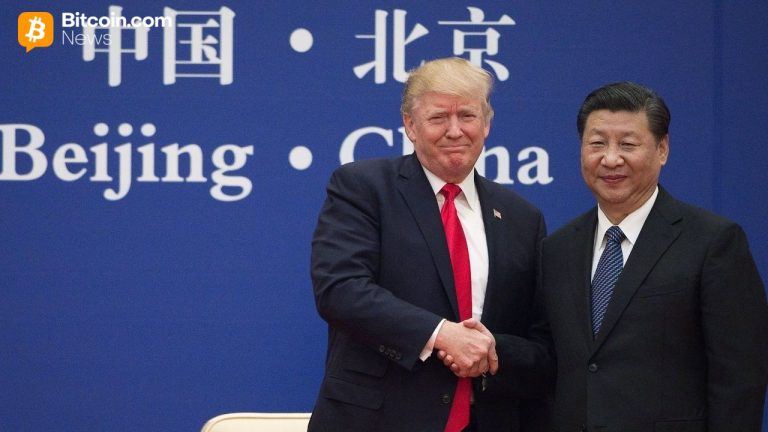

Peter Schiff Warns US–China Trade Deal Won’t Stop De-Dollarization or Soaring Deficits

NegativeCryptocurrency

Peter Schiff has raised concerns that the recent US-China trade deal will not prevent the ongoing trend of de-dollarization or the increasing deficits faced by the United States. This is significant as it highlights the potential long-term economic challenges for the US, suggesting that despite diplomatic efforts, the reliance on the dollar may continue to diminish, impacting global trade dynamics and financial stability.

— Curated by the World Pulse Now AI Editorial System