Tokenized gold market value surpasses $3b, sets record high

PositiveCryptocurrency

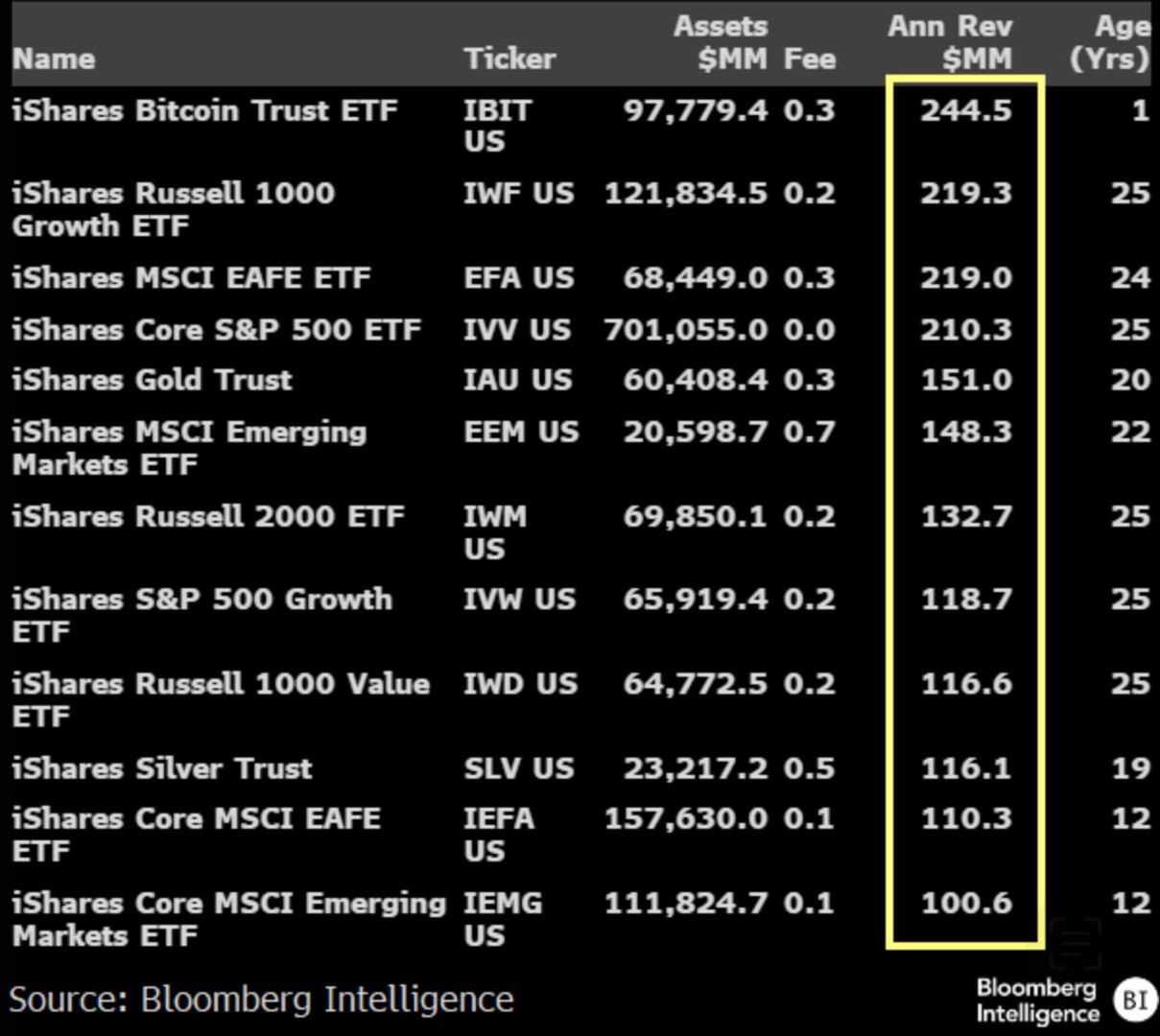

The tokenized gold market has hit a remarkable milestone, surpassing $3.02 billion in value as of October 7, 2025. This surge reflects a growing interest among investors in blockchain-based assets, showcasing how traditional commodities like gold are evolving in the digital age. As more people turn to tokenized forms of precious metals, it highlights a significant shift in investment strategies and the potential for greater accessibility and liquidity in the gold market.

— Curated by the World Pulse Now AI Editorial System