Crypto Leverage Trading in Focus: How Leverage.Trading Data Tracks Retail Stress From Liquidations to Early Warnings

NeutralCryptocurrency

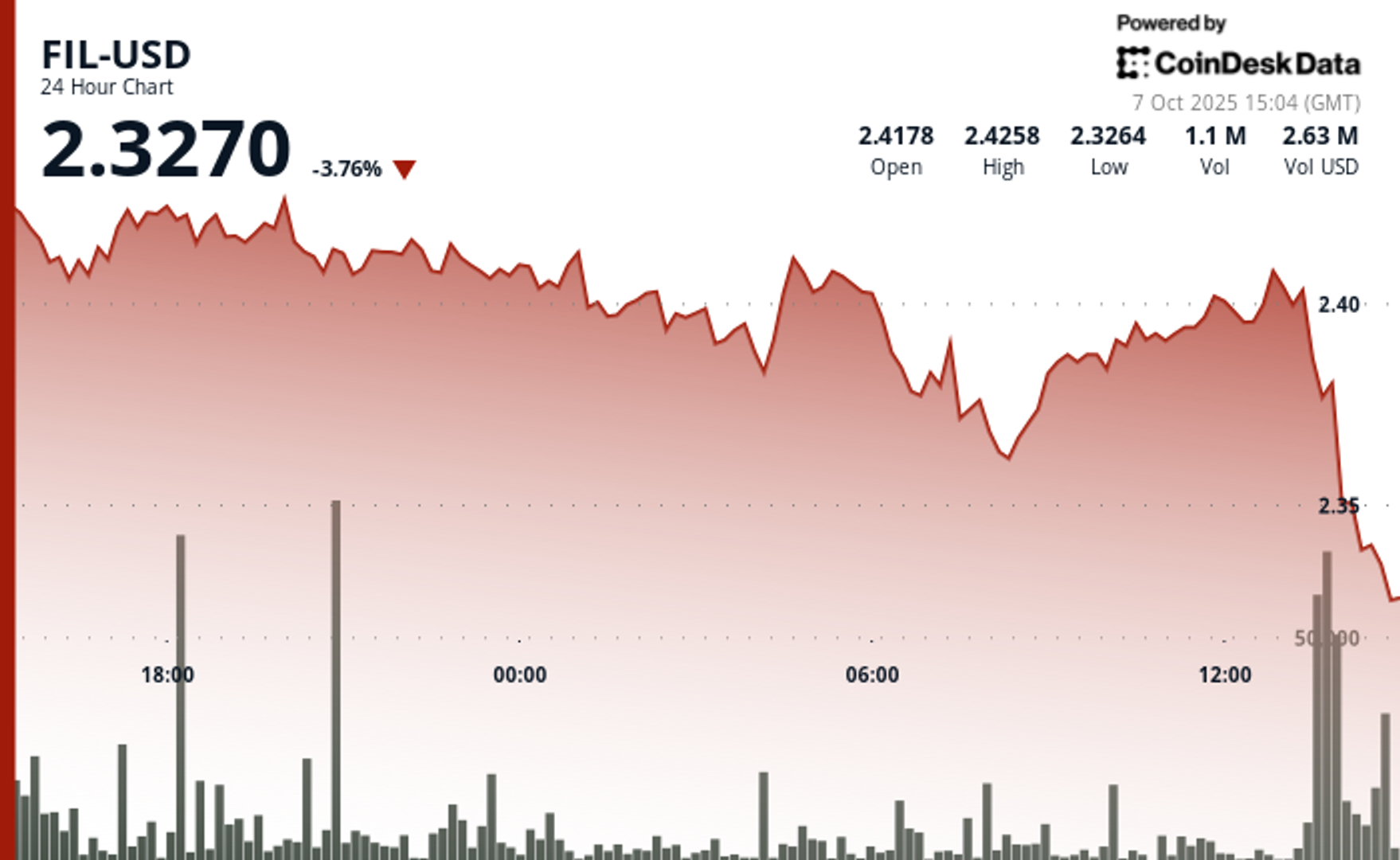

Leverage.Trading's latest data reveals how retail traders assess risk in the volatile crypto and equities markets. While many headlines focus on the aftermath of market downturns, this report provides insights into traders' behaviors and stress levels before liquidations occur. Understanding these patterns is crucial for both traders and investors, as it highlights the importance of risk management in a rapidly changing financial landscape.

— Curated by the World Pulse Now AI Editorial System