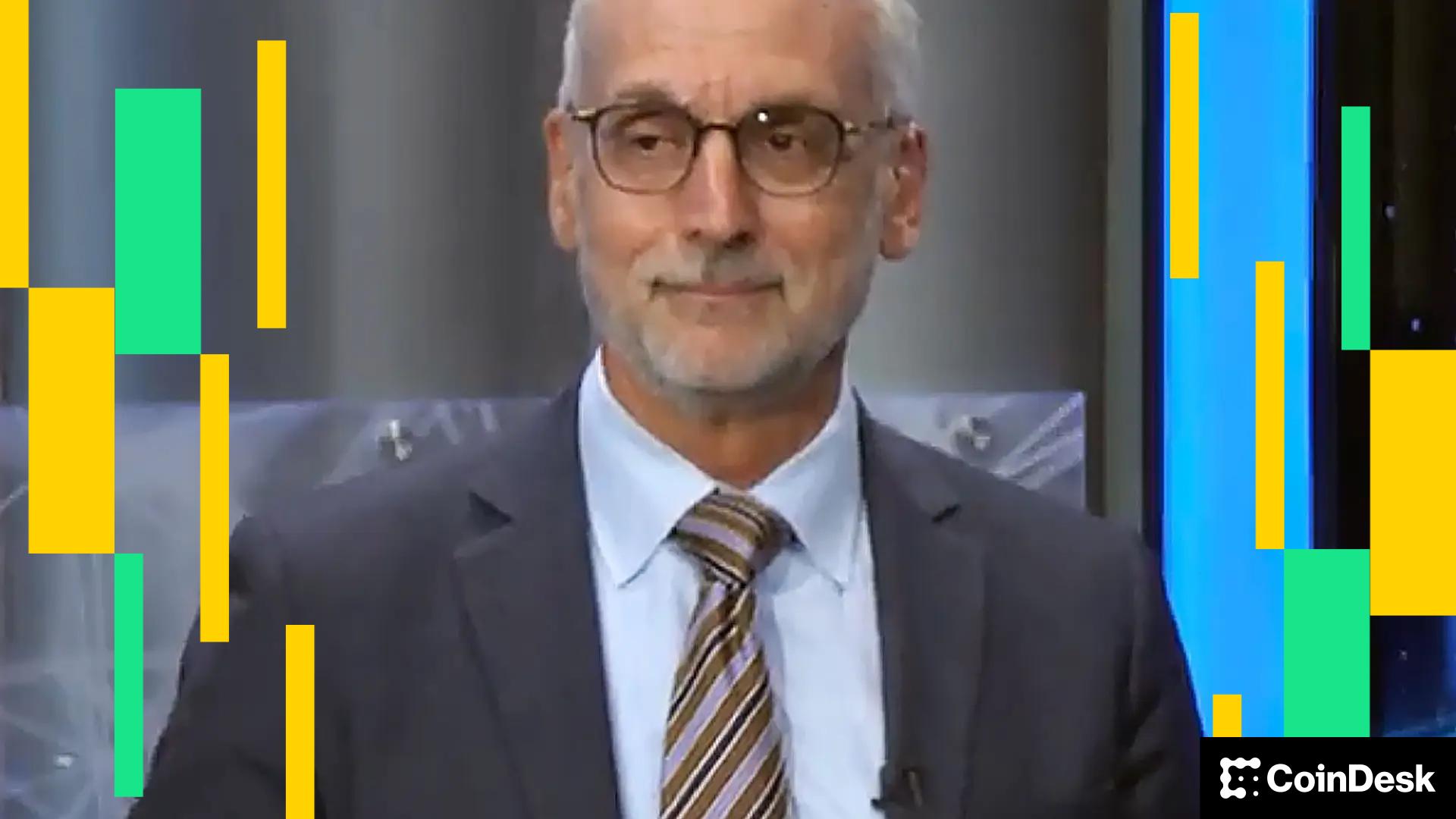

Algorand Foundation Names Former Ripple Engineer Nikolaos Bougalis CTO

PositiveCryptocurrency

The Algorand Foundation has appointed former Ripple engineer Nikolaos Bougalis as its new CTO, signaling a strategic move to enhance its technology and strengthen its presence in the U.S. This hire is significant as it reflects Algorand's commitment to scaling its tech stack, which could lead to improved performance and innovation in the blockchain space.

— Curated by the World Pulse Now AI Editorial System