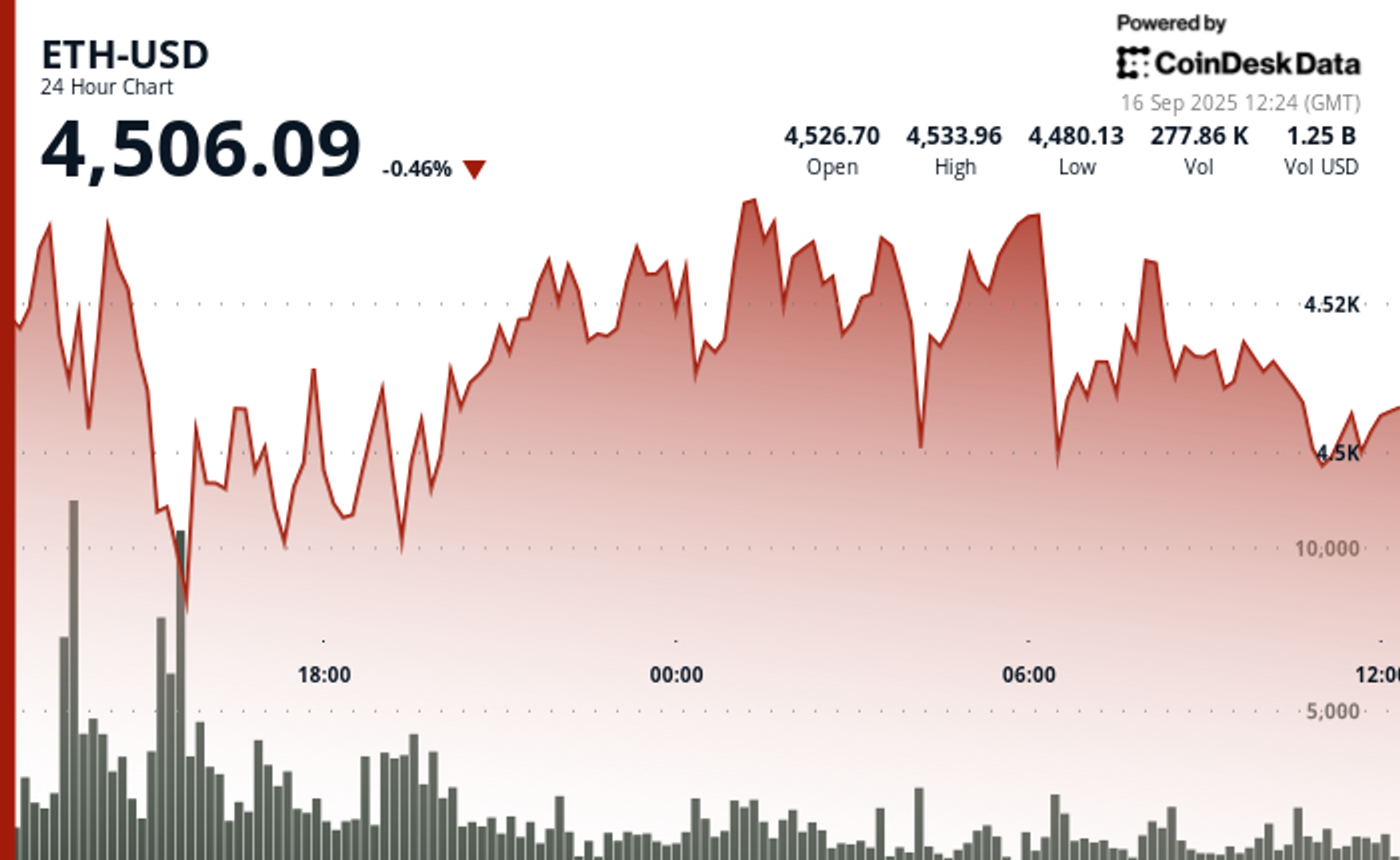

ETH Going to $5,500 by Mid-October, Says Fundstrat’s Global Head of Technical Strategy

PositiveCryptocurrency

Fundstrat's Global Head of Technical Strategy predicts that Ethereum (ETH) could reach $5,500 by mid-October, indicating strong market confidence.

Editor’s Note: This prediction is significant as it reflects the growing optimism in the cryptocurrency market, potentially influencing investor behavior and market trends.

— Curated by the World Pulse Now AI Editorial System