Here’s why the Bless crypto price pumped 230% today

PositiveCryptocurrency

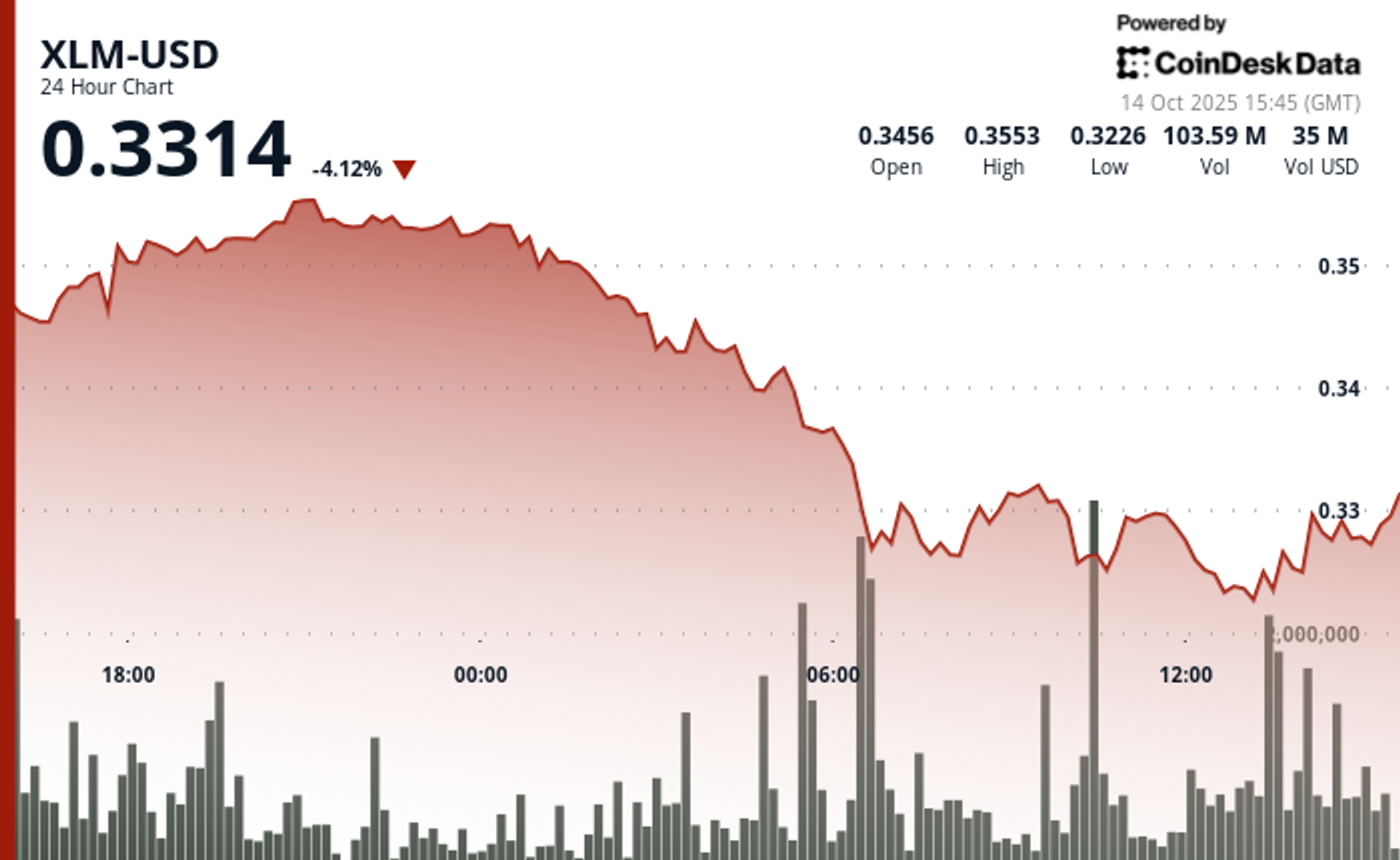

The Bless crypto price surged by an impressive 230% on October 15, reaching an all-time high of $0.1125, even amidst a broader downturn in the crypto market. This remarkable increase is significant as it highlights the resilience of certain cryptocurrencies, like Bless Network, which managed to defy market trends and attract investor interest. Such price movements can indicate growing confidence in the project and may encourage further investment, making it a noteworthy event in the ever-evolving crypto landscape.

— Curated by the World Pulse Now AI Editorial System