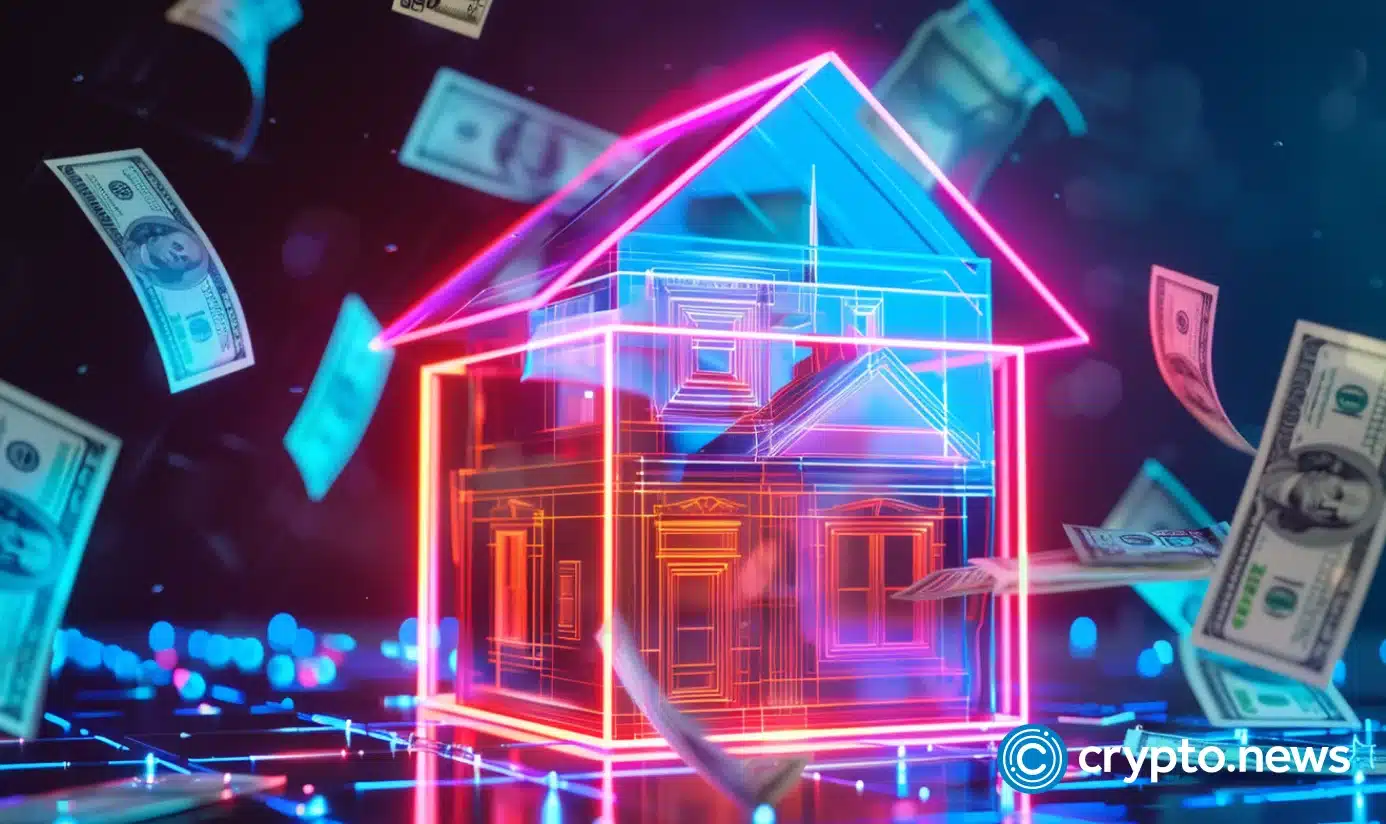

Opendoor signals plan to accept Bitcoin for home purchases

PositiveCryptocurrency

Opendoor, the innovative real estate fintech, is making waves by signaling its intention to accept Bitcoin and other cryptocurrencies for home purchases. This move not only highlights the growing acceptance of digital currencies in mainstream markets but also has the potential to attract a new wave of tech-savvy buyers. With CEO Kaz Nejatian at the helm, Opendoor is positioning itself at the forefront of the evolving real estate landscape, which could lead to increased retail interest and investment in both the company and the crypto market.

— Curated by the World Pulse Now AI Editorial System