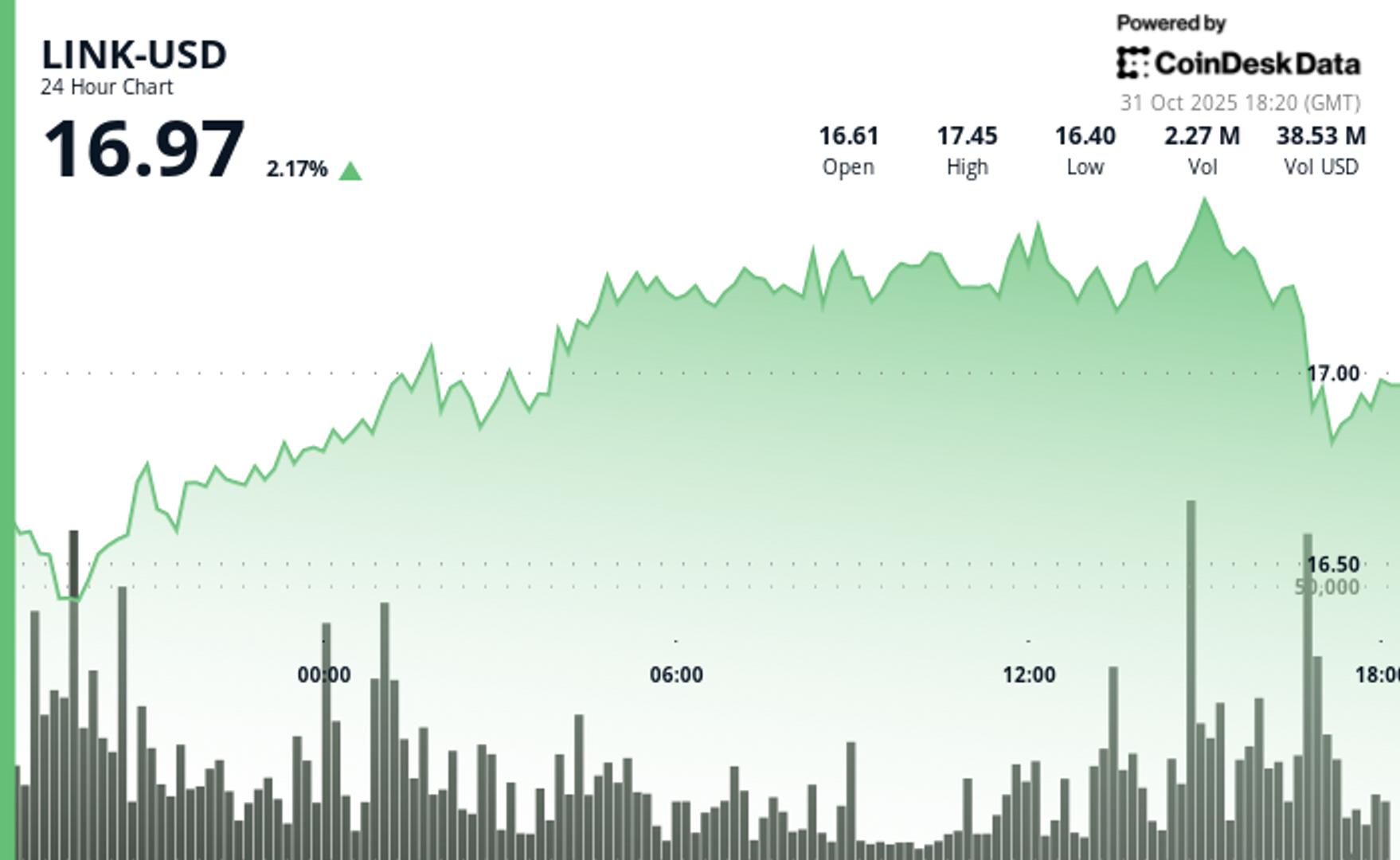

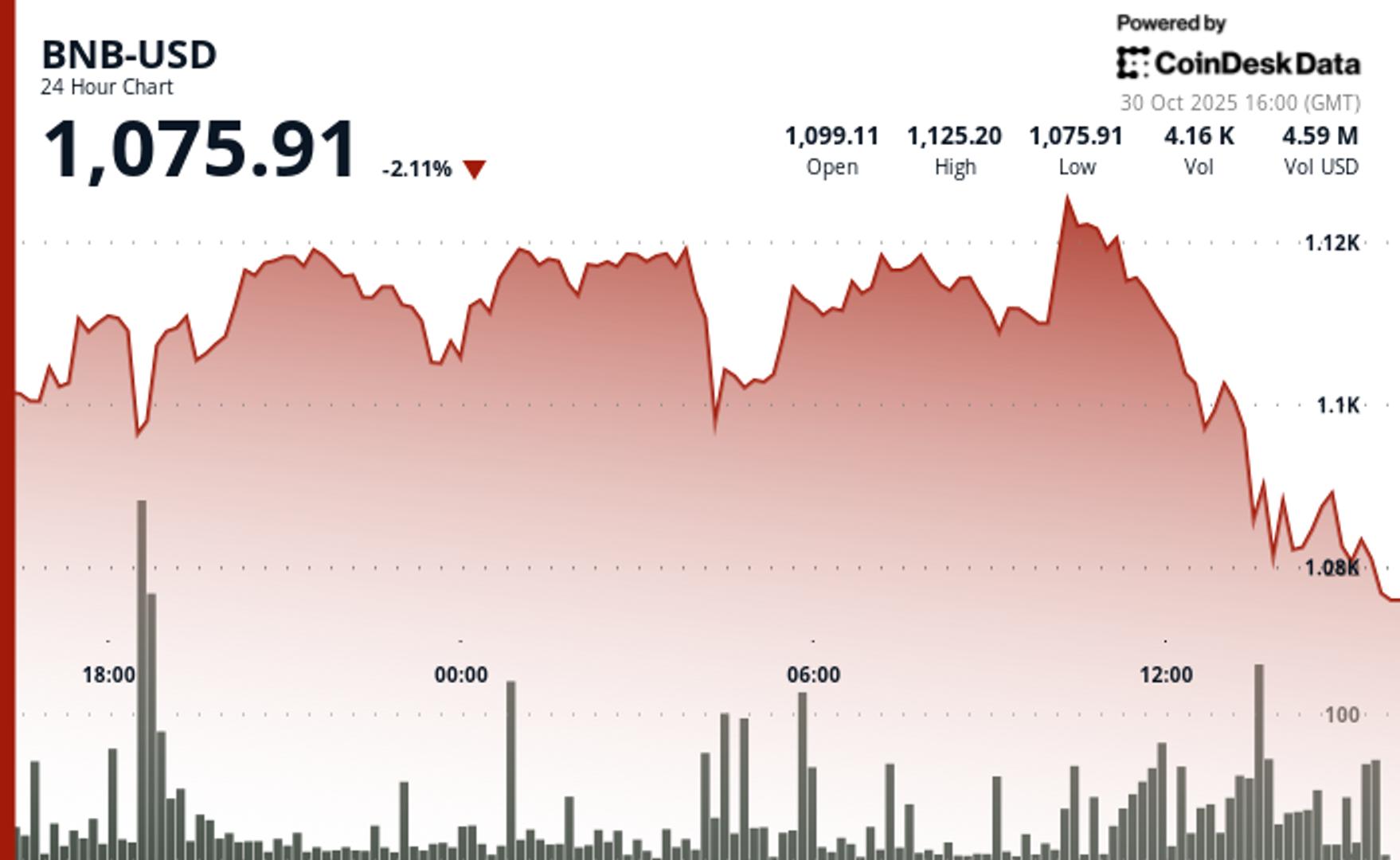

BNB Slips Below Support as Broader Crypto Market Reacts to Fed Chair's Remarks

NegativeCryptocurrency

The recent comments from Fed Chair Jerome Powell regarding a 25 basis point rate cut have triggered a significant downturn in the crypto market, causing BNB to slip below its support level. This reaction is notable as it reflects broader investor concerns, leading to over $1.1 billion in liquidations within just 24 hours. Understanding these market dynamics is crucial for investors as they navigate the volatile landscape of cryptocurrencies.

— Curated by the World Pulse Now AI Editorial System