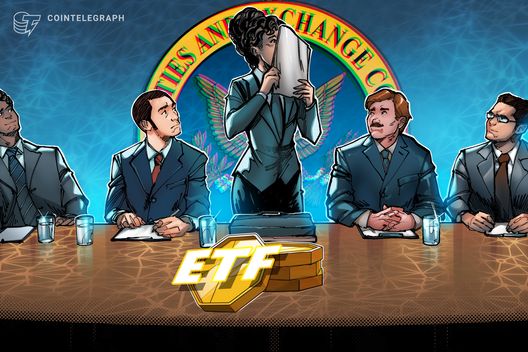

REX-Osprey launches Ethereum staking ETF in US

PositiveCryptocurrency

REX-Osprey has made a significant move by launching the first Ethereum staking ETF in the US, allowing investors to gain direct exposure to ETH while earning on-chain yields. This development is important as it opens up new investment opportunities in the growing cryptocurrency market, making it easier for individuals to participate in Ethereum staking.

— Curated by the World Pulse Now AI Editorial System