Standard Chartered sees $2T in tokenized RWAs by 2028, matching stablecoins

PositiveCryptocurrency

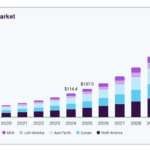

Standard Chartered has projected that the tokenized real-world assets (RWAs) market could reach $2 trillion by 2028, which would put it on par with the stablecoin market. This insight comes from the bank's head of research, who noted that the current $300 billion stablecoin market capitalization has already catalyzed a self-sustaining growth cycle in decentralized finance (DeFi). This development is significant as it highlights the increasing integration of traditional finance with blockchain technology, potentially reshaping investment landscapes and offering new opportunities for investors.

— Curated by the World Pulse Now AI Editorial System