What Will US Economic Data Mean For Crypto Crash? Latest SEC News, Prelim GDP, Jobless Claims and Core PC

NegativeCryptocurrency

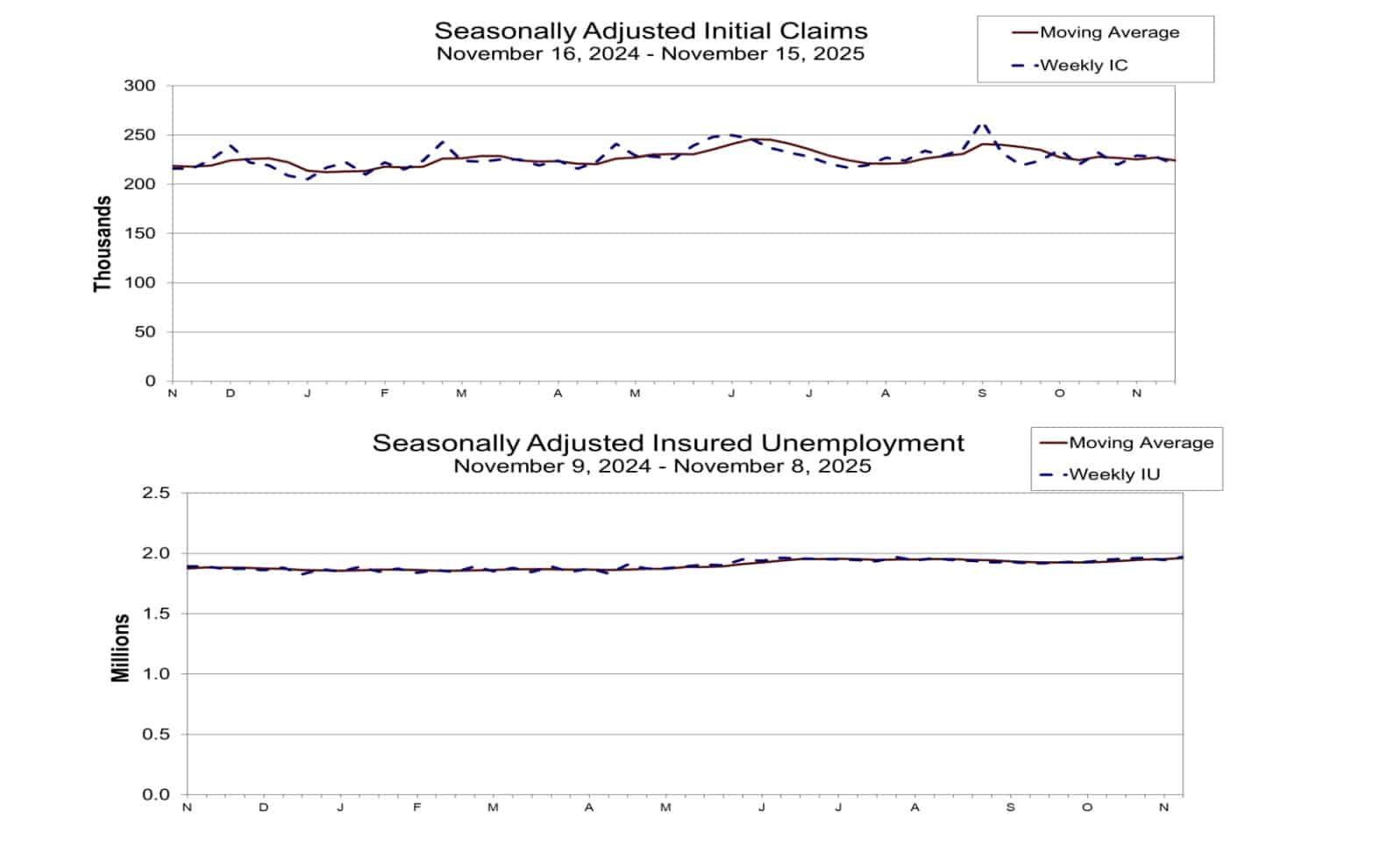

- Macro uncertainty is resurfacing, impacting the cryptocurrency sector as traders prepare for significant U.S. economic data releases and regulatory signals from the SEC. The crypto market remains under pressure, with Bitcoin's price recently dropping toward critical levels, raising concerns about a potential crash.

- The implications of this economic data are crucial for the cryptocurrency market, as they may influence investor sentiment and regulatory actions. The SEC's stance on digital assets could either stabilize or further destabilize the market, depending on the forthcoming announcements.

- This situation reflects broader trends in the cryptocurrency market, where volatility has been exacerbated by external economic factors, including Federal Reserve policies and market reactions to inflation and job reports. The ongoing bear market has intensified discussions about the future of digital assets and their regulatory landscape.

— via World Pulse Now AI Editorial System