TeraWulf looks to raise $500M as it bets big that AI is new Bitcoin

PositiveCryptocurrency

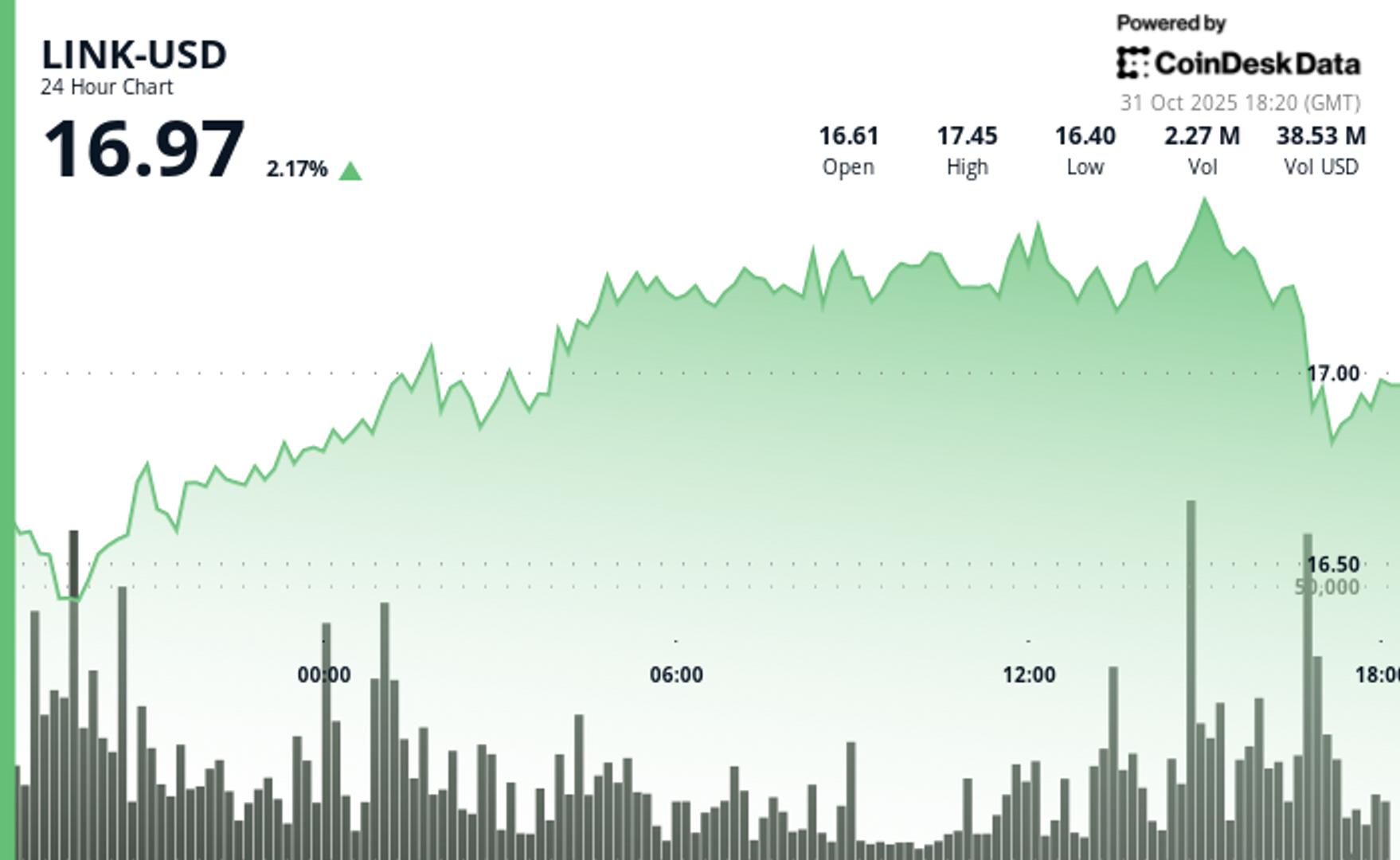

TeraWulf is making headlines as it seeks to raise $500 million, betting on artificial intelligence as the next big thing, akin to Bitcoin. This move comes on the heels of a significant $3 billion financing effort backed by Morgan Stanley and Google, along with a $3.7 billion hosting deal with Fluidstack. This ambitious strategy highlights TeraWulf's confidence in the future of AI and its potential to reshape the financial landscape, making it a noteworthy development in the tech and investment sectors.

— Curated by the World Pulse Now AI Editorial System