Bit Digital buys 31K ETH worth $140M, becomes 6th-largest Ethereum treasury

PositiveCryptocurrency

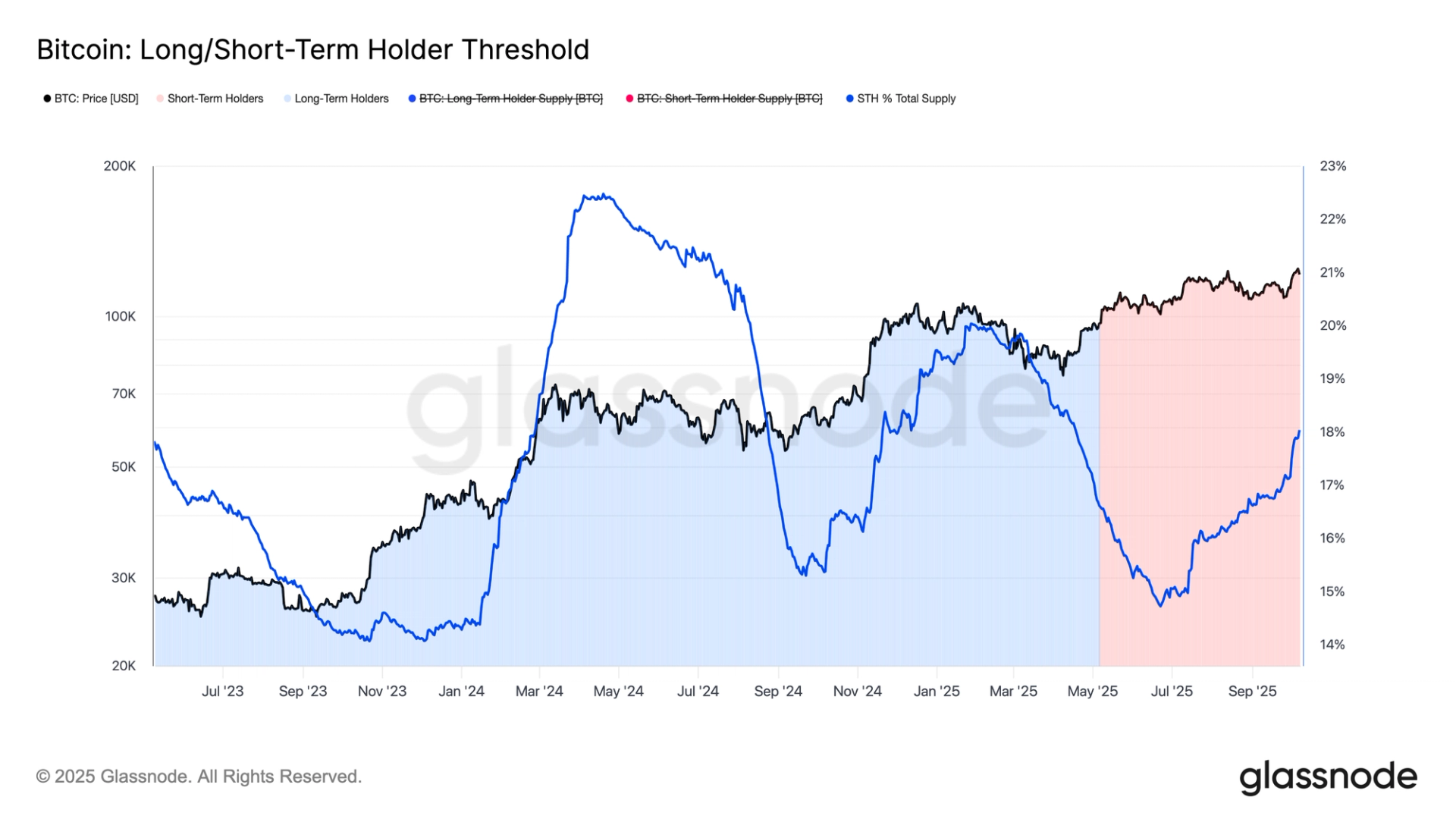

Bit Digital has made a significant move by purchasing 31,057 ETH for $140 million, which boosts its total holdings to over 150,000 ETH. This acquisition positions Bit Digital as the sixth-largest Ethereum treasury, highlighting its growing influence in the cryptocurrency market. Such investments not only reflect confidence in Ethereum's future but also indicate a trend of increasing institutional interest in digital assets.

— Curated by the World Pulse Now AI Editorial System