UK lifts retail ban on crypto ETPs, unlocking access to a £800B market

PositiveCryptocurrency

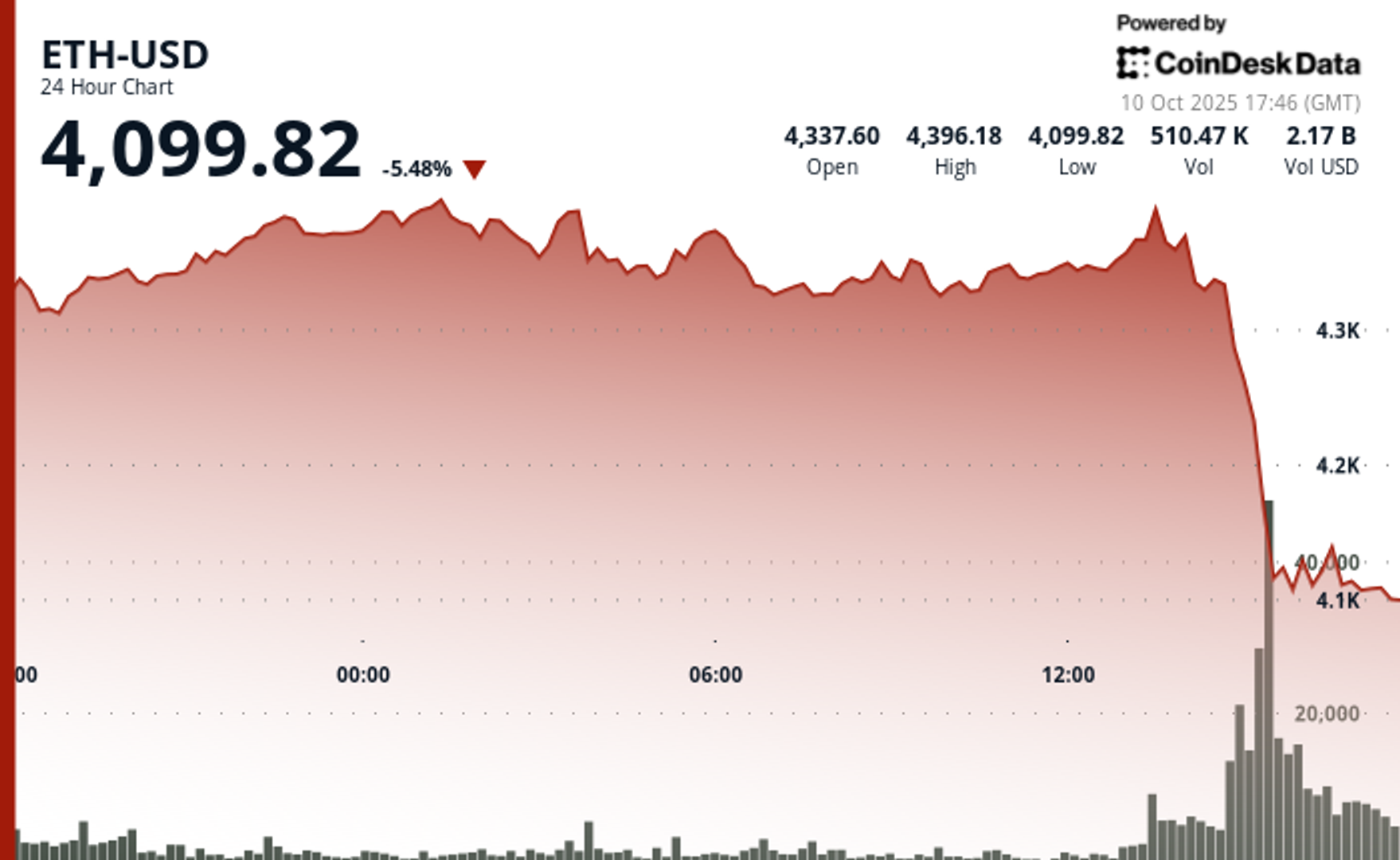

The UK has made a significant move towards embracing cryptocurrency by lifting its ban on retail trading of crypto exchange-traded products (ETPs). This decision, announced by the Financial Conduct Authority (FCA) on October 8, allows retail investors to access a market valued at £800 billion, which was previously restricted due to concerns over volatility and consumer protection. This change not only opens up new investment opportunities for individuals but also signals a broader acceptance of cryptocurrencies in the financial landscape.

— Curated by the World Pulse Now AI Editorial System