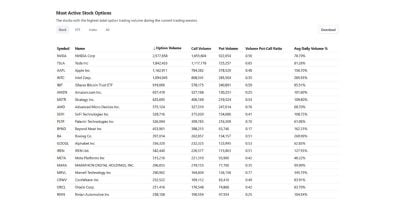

BlackRock's Spot Bitcoin ETF Options Secure U.S. Top 10 Ranking With 7.7M Active Contracts

NeutralCryptocurrency

- BlackRock's spot Bitcoin ETF options have achieved a significant milestone, securing a top 10 ranking in the U.S. with 7.7 million active contracts. This achievement highlights the growing interest and participation in cryptocurrency investment through exchange-traded funds (ETFs).

- The success of BlackRock's Bitcoin ETF is crucial for the firm as it has emerged as the largest revenue source, generating substantial fees and contributing to the firm's overall profitability. This shift underscores the importance of cryptocurrency in modern investment strategies.

- The rise of Bitcoin ETFs reflects a broader trend in the financial industry, where traditional investment firms are increasingly integrating cryptocurrency products. This development comes amid fluctuating market conditions, with recent inflows indicating renewed investor confidence, contrasting with previous periods of volatility and outflows.

— via World Pulse Now AI Editorial System