Aptos partners with Trump family’s WLFI to integrate USD1

PositiveCryptocurrency

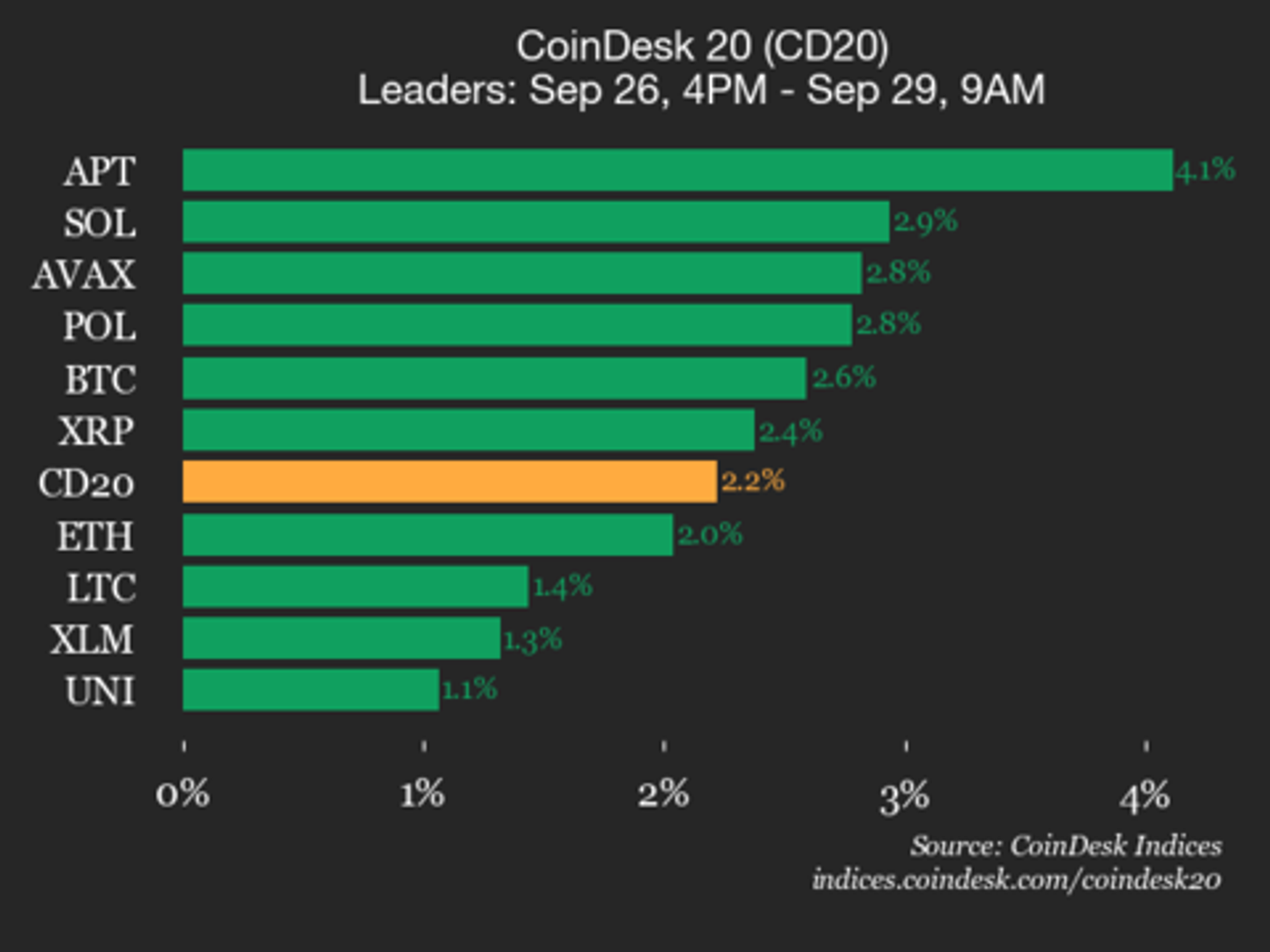

Aptos has teamed up with World Liberty Financial, a company linked to the Trump family, to launch USD1 stablecoins. This partnership is significant as it aims to capture a share of the competitive stablecoin market, particularly targeting Tron. The collaboration not only highlights Aptos's innovative approach in the cryptocurrency space but also reflects the growing interest in stablecoins as a reliable digital asset.

— Curated by the World Pulse Now AI Editorial System