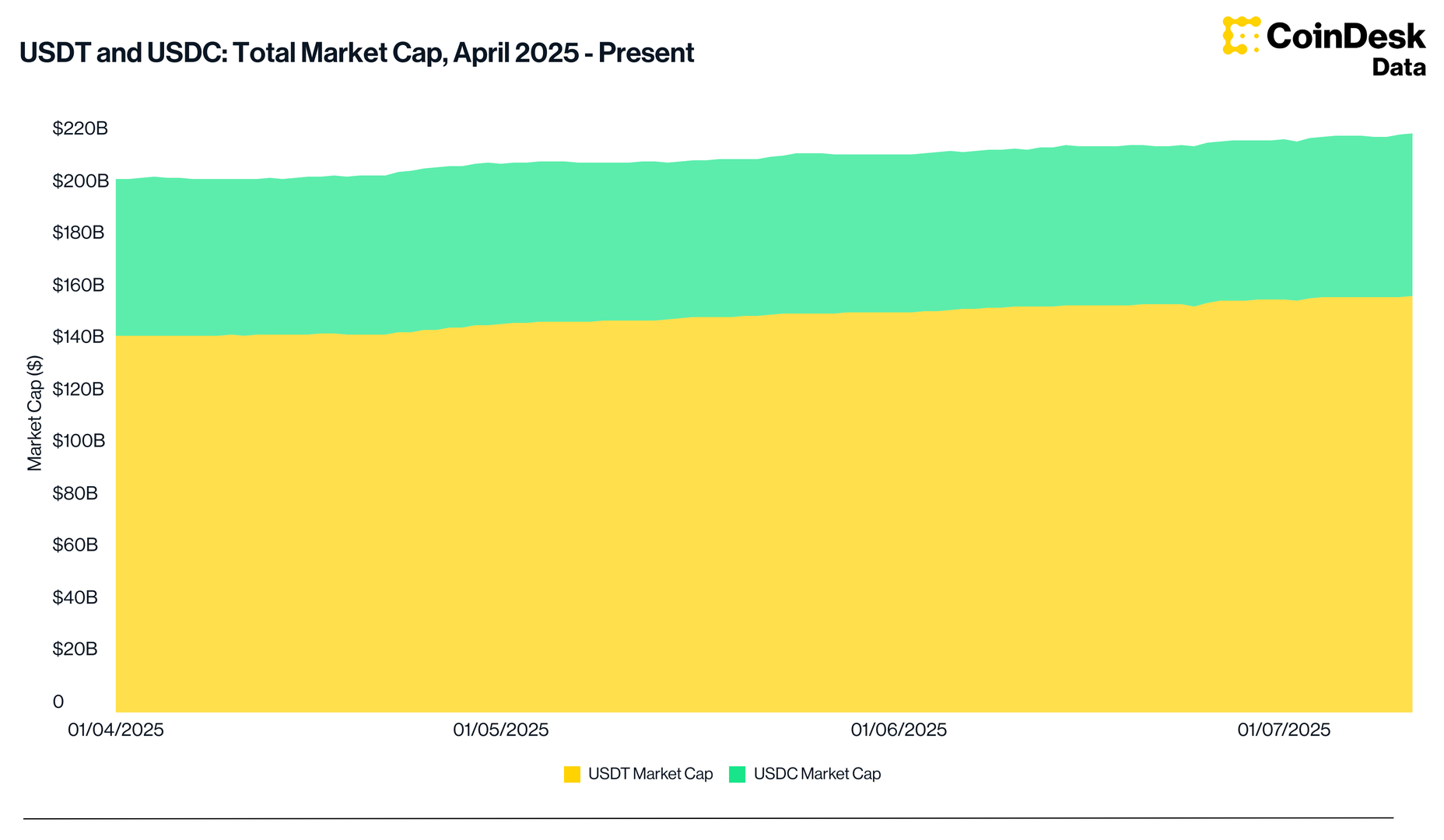

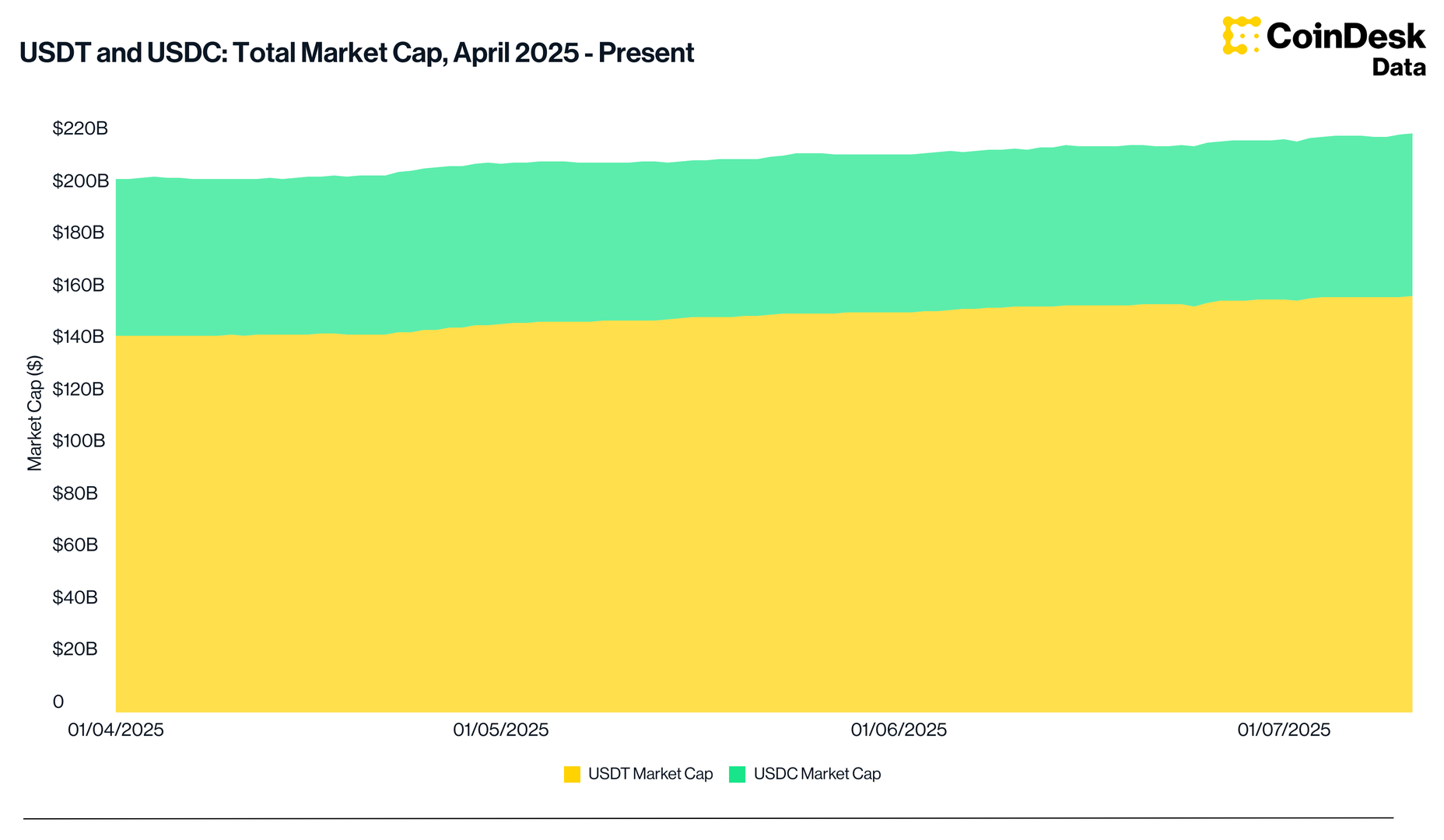

Tether/Circle Stablecoin Supply Growth Signals Strong Liquidity Backing Crypto Rally

Stablecoins like Tether and Circle are gaining traction with strong liquidity, fueling a crypto rally, while China may soften its stance on digital assets. TRON is expanding its role in stablecoin settlements, highlighting growing adoption.

All major sources, one page

Feel the mood behind headlines

Know what’s trending, globally

Get summaries. Save time

9,957

145

211

29 minutes ago

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

All major sources, one page

Feel the mood behind headlines

Know what’s trending, globally

Get summaries. Save time

9,957

145

211

29 minutes ago

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more