Palantir stock falls 7% amid CEO Karp’s criticism of short sellers

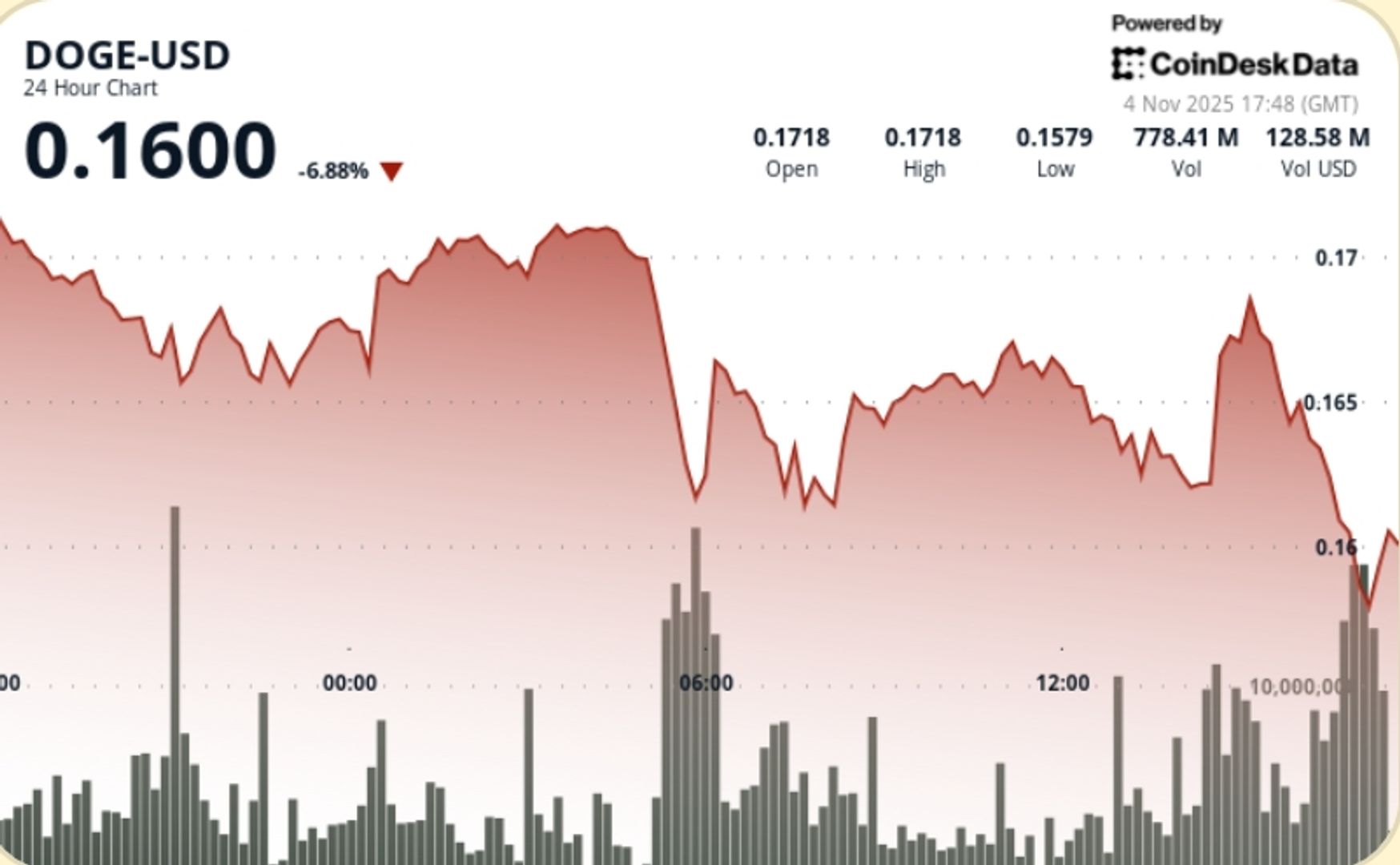

NegativeCryptocurrency

Palantir's stock has dropped by 7% following CEO Alex Karp's sharp criticism of short sellers, highlighting the ongoing tensions between innovative companies and those betting against them. This decline raises concerns about investor confidence in the AI sector, as it reflects broader market anxieties and the challenges faced by firms pushing the boundaries of technology.

— Curated by the World Pulse Now AI Editorial System