Citadel Pushes SEC For DeFi Oversight, Crypto Heavyweights Push Back Harder

NegativeCryptocurrency

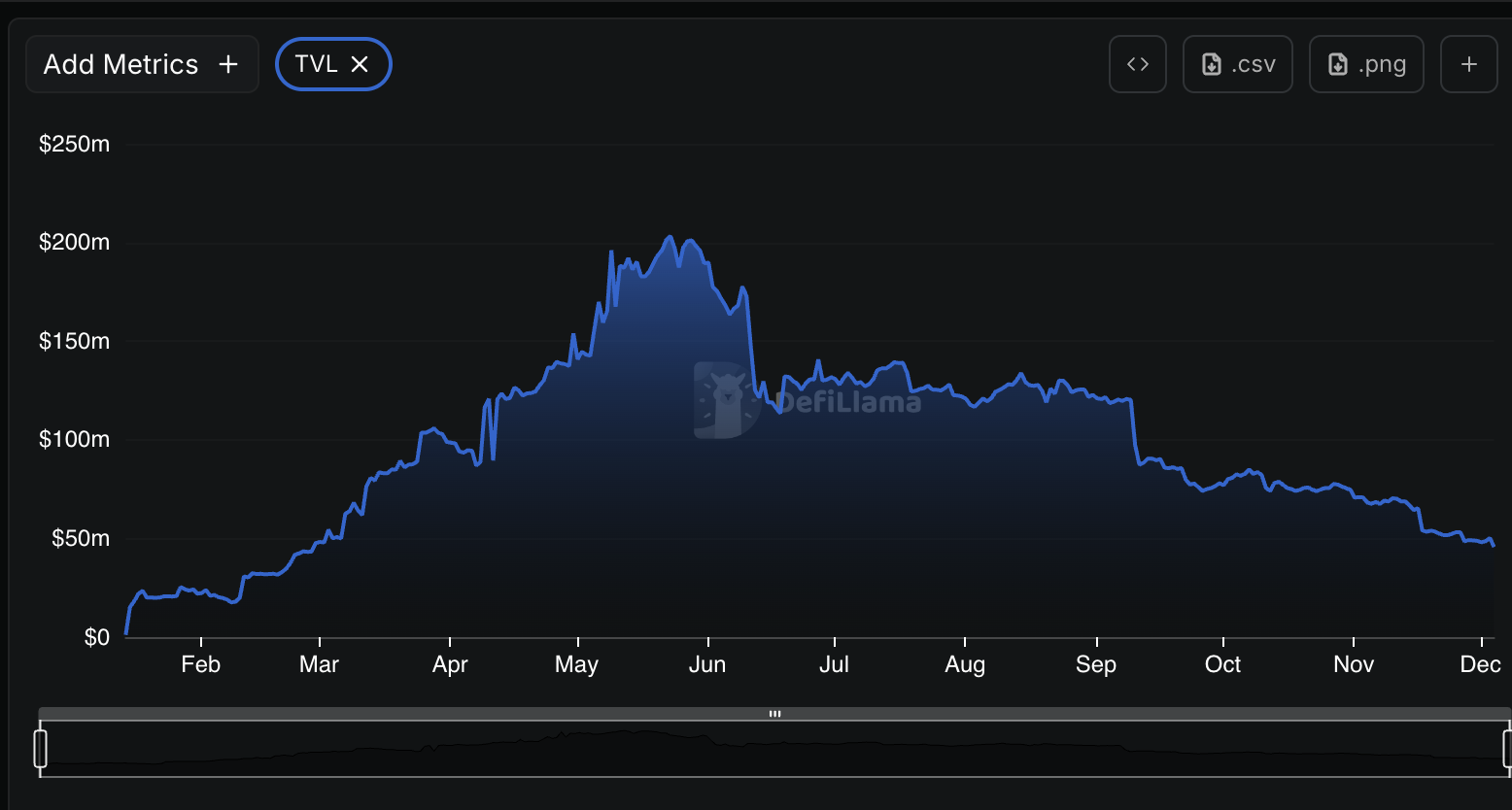

- Citadel has urged the U.S. Securities and Exchange Commission (SEC) to impose regulations on decentralized finance (DeFi) similar to those applied to traditional finance (TradFi), igniting significant backlash from the crypto community that values DeFi's independence from conventional financial systems.

- This push for regulation by Citadel is seen as a critical move that could reshape the DeFi landscape, as it seeks to bring tokenized stocks and other DeFi platforms under the SEC's oversight, potentially limiting their operational freedom.

- The controversy highlights an ongoing tension between traditional financial institutions and the emerging DeFi sector, with industry leaders voicing strong opposition to Citadel's stance, emphasizing the need for DeFi to remain distinct from traditional regulatory frameworks.

— via World Pulse Now AI Editorial System