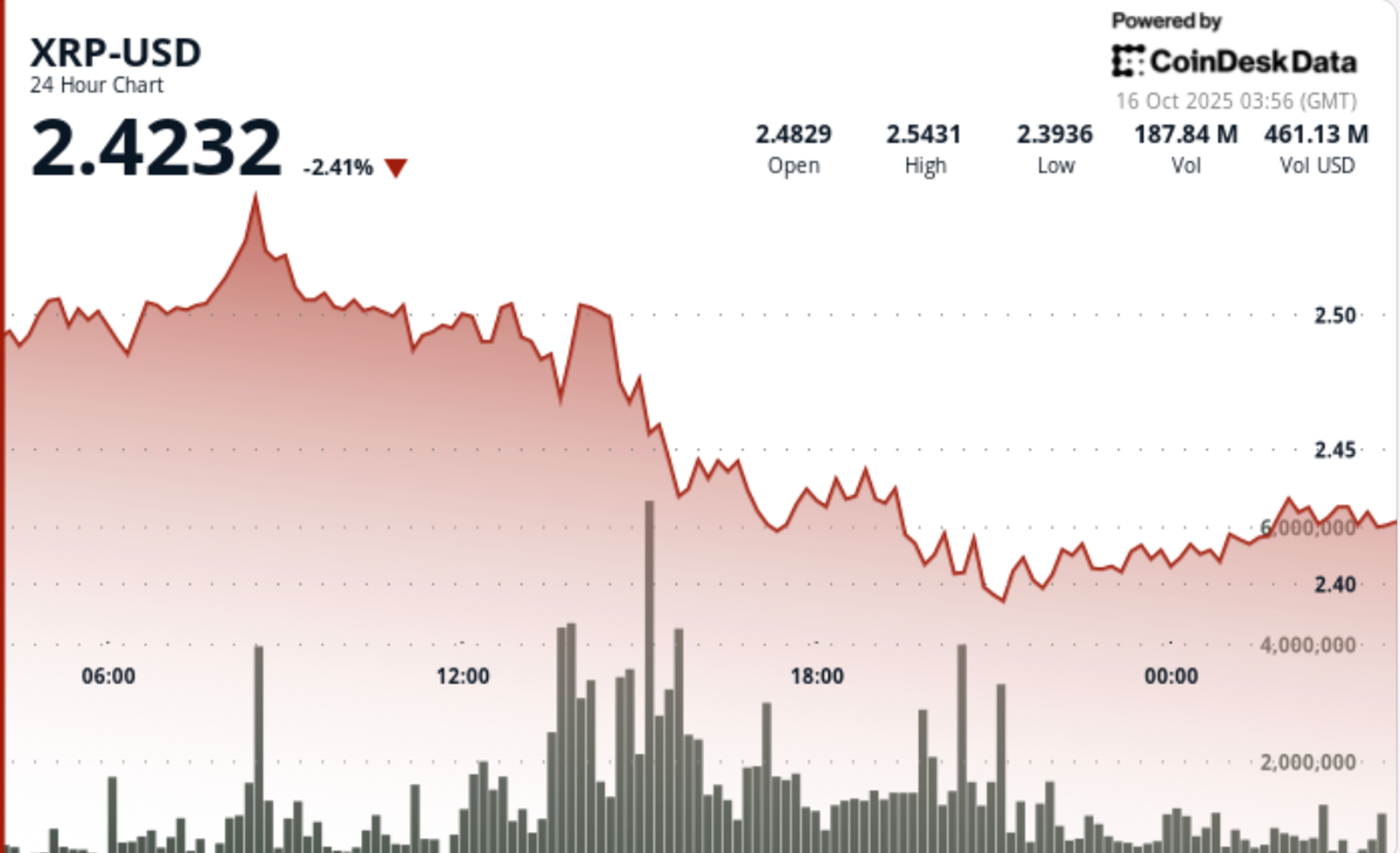

XRP Buildout Near $2.40 Could Precede Sharp Relief Rally if Whales Ease Pressure

PositiveCryptocurrency

The recent buildout of XRP near the $2.40 mark has sparked optimism among investors, suggesting that a significant relief rally could be on the horizon if large holders, known as whales, decide to ease their selling pressure. This potential shift is crucial as it could lead to increased market confidence and a surge in XRP's value, benefiting both traders and the broader cryptocurrency ecosystem.

— Curated by the World Pulse Now AI Editorial System